OM Crypto News: How OM Is Leading the Real-World Asset Tokenization Wave

OM Leads the Real-World Asset (RWA) On-Chain Wave

While most eyes remain fixed on meme coins and exchange headlines, OM (Mantra) has quietly shifted its focus to a sector that offers more enduring value: the on-chain tokenization of real-world assets (RWA). This isn’t just a lofty vision—it’s an active, ongoing process that actively reshapes assets on the blockchain.

By mid-2025, OM has already enabled the on-chain tokenization and tracking of over $119 million in real-world assets. Through a series of cross-sector collaborations, OM is building a diverse, compliant ecosystem for asset tokenization.

OM’s RWA Strategy

OM goes beyond technical prowess—it’s bringing blockchain into areas of traditional finance once considered out of reach, such as:

- Real Estate Assets: Through partnerships with leading tokenization providers, OM brings regulated real estate onto the blockchain, leveraging Dubai’s regulatory framework to develop a secure, trustworthy on-chain financial model.

- Agriculture and Carbon Credits: OM collaborates with agri-tech platform Dimitra to tokenize agricultural products like cocoa and carbon credits. This effort drives innovation while meeting modern ESG standards.

- Sports Economy Tokenization: OM and WIN Investments have introduced transfer tokens. This enables soccer fans to participate in player transfer revenue. This model incorporates FIFA’s Solidarity mechanism, allowing fans a share of future revenue distributions.

These use cases are more than just marketing—they comprise real, operational financial models and are already operating.

Expanding Global Partnerships

On the expansion front, OM is targeting emerging markets across Latin America. In Brazil, the country’s largest crypto exchange, Mercado Bitcoin, plans to partner with OM to tokenize over $200 million in assets by 2025—a major milestone for blockchain’s integration with traditional finance. This partnership not only boosts OM’s profile in South America. It also highlights the platform’s flexible and scalable technical infrastructure.

Key Long-Term Considerations

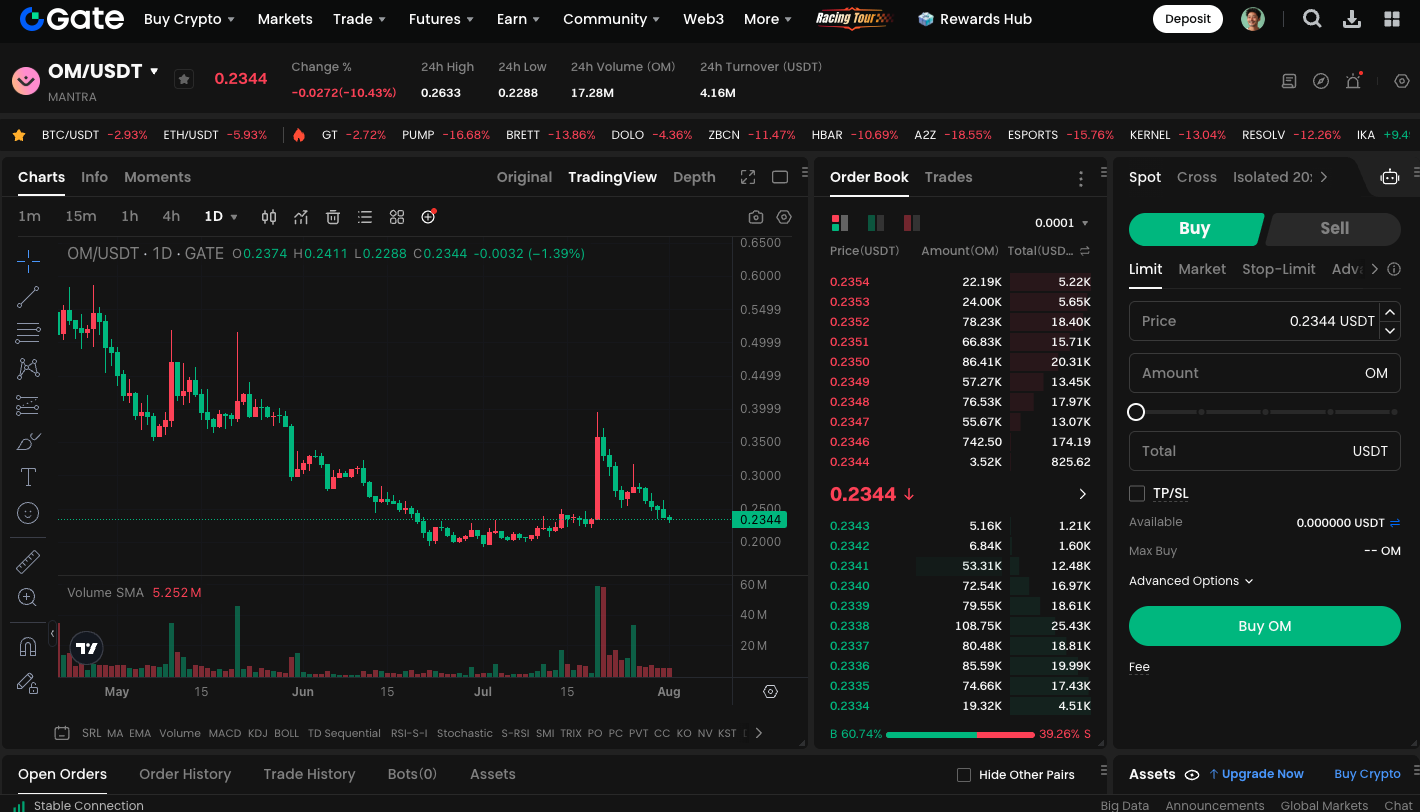

With OM trading at approximately $0.27, its current valuation may be understated relative to the project’s expanding industry integration and tokenomics foundation. As the global shift toward programmable, on-chain assets accelerates, projects with proven compliance partnerships and real-world deployments will maintain a first-mover advantage in the market.

Get started with OM spot trading now: https://www.gate.com/trade/OM_USDT

Summary

OM is driving the transformation of real-world finance through blockchain. From real estate to soccer, carbon credits to agriculture. OM isn’t just imagining possibilities—it’s actively reshaping how real-world capital interacts with blockchain. For those seeking projects backed by true industry integration and global partnerships—not just community hype. OM should be on your long-term watchlist.