LongzhiTradingContractCompound

Copy traders, please set the simple mode, and you can copy trade in proportion!

(If you want to learn more about the trading team, please press 888 in the live channel) With decades of trading experience, always respect the market, and always carry out compound interest to the end! Everything is result-oriented, how to evaluate the effectiveness of the results?

Pin

LongzhiTradingContractCompound

2025 Longzhi Trading Second Half Live Channel Strategy Details!

(Must-Read for Beginners)

View Original(Must-Read for Beginners)

- Reward

- 2

- 5

- Repost

- Share

AdultSelf :

:

Brother Long, the live broadcast is online.View More

Strategy plan for the evening of December 8.

View OriginalSubscribers Only

Subscribe now to view exclusive content- Reward

- like

- Comment

- Repost

- Share

#晒出我的持仓收益# Attention everyone, the target has not been reached. Move away directly when approaching the target position, do not hesitate.

View Original

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

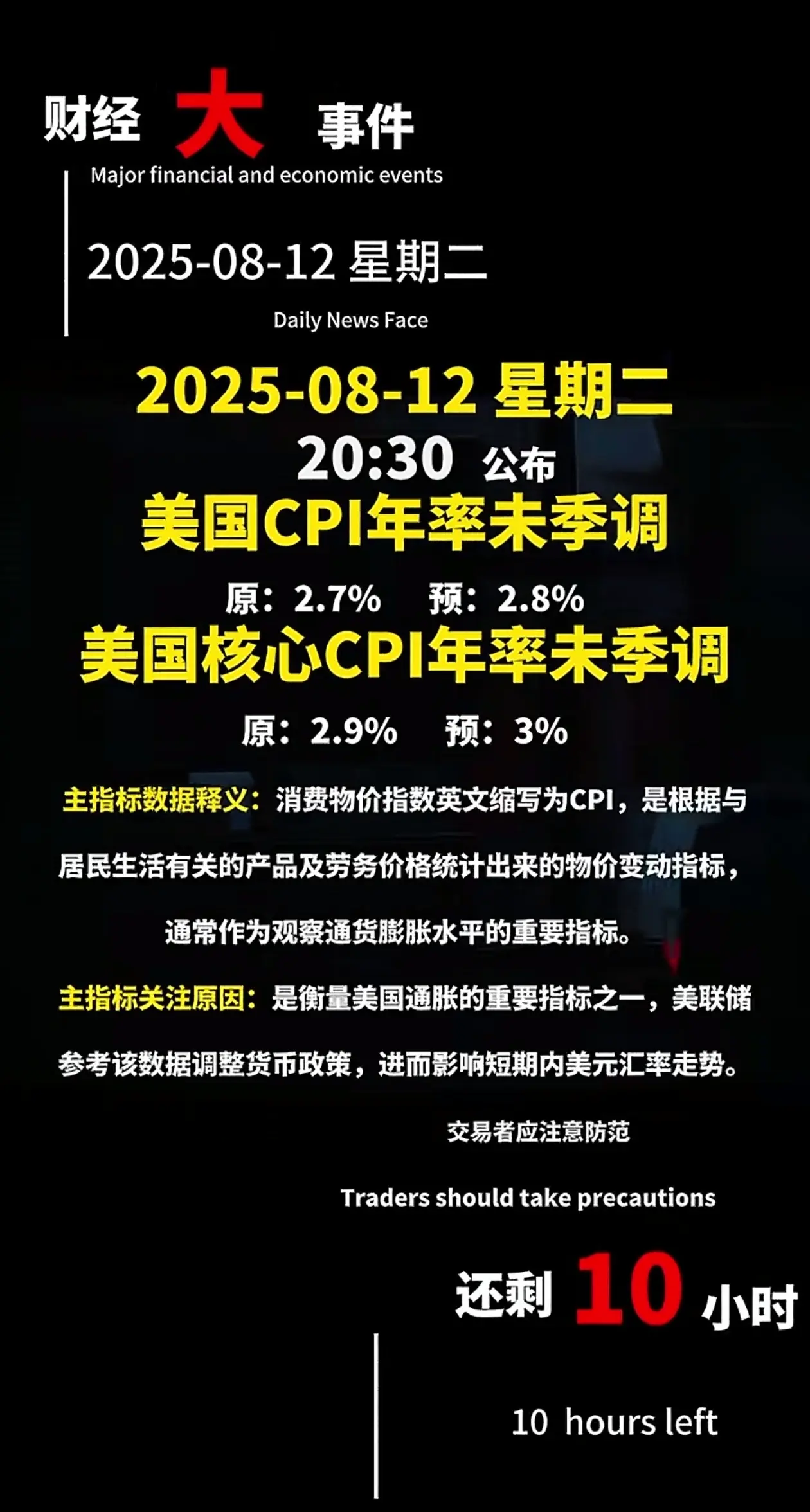

The impact of the US CPI data on Crypto Assets (especially Ethereum) is mainly transmitted through the following paths, with the core logic being inflation expectations → Fed policy → USD Liquidity → pricing of risk assets:

1. Data above expectations (e.g., core CPI reaching 3%)

Path:

CPI exceeded expectations → Market strengthens "stubborn high inflation" expectations → Fed delays interest rate cuts/maintains high rates → US dollar strengthens + risk assets sold off → Crypto Assets under pressure

Specific impact on Ethereum:

- Short-term downward pressure: A stronger US Dollar Index (DXY) may

View Original1. Data above expectations (e.g., core CPI reaching 3%)

Path:

CPI exceeded expectations → Market strengthens "stubborn high inflation" expectations → Fed delays interest rate cuts/maintains high rates → US dollar strengthens + risk assets sold off → Crypto Assets under pressure

Specific impact on Ethereum:

- Short-term downward pressure: A stronger US Dollar Index (DXY) may

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

hardcore fan strategy order!⚠️

Please note! ⚠️⚠️⚠️

New fans, welcome to start your subscription to obtain the wealth password.

Hardcore fans, please like 💞 follow ➕ comment 💰💰

💵💵💵💵💵💵💵💵💵💵💵💵

View OriginalPlease note! ⚠️⚠️⚠️

New fans, welcome to start your subscription to obtain the wealth password.

Hardcore fans, please like 💞 follow ➕ comment 💰💰

💵💵💵💵💵💵💵💵💵💵💵💵

Subscribers Only

Subscribe now to view exclusive content- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Evening strategy plan for 08.11.

View OriginalSubscribers Only

Subscribe now to view exclusive content- Reward

- like

- Comment

- Repost

- Share

hardcore fan strategy order!⚠️

Please note! ⚠️⚠️⚠️

New fans, friends, "Welcome to subscribe and obtain the wealth code"

Hardcore fans, please like 💞 follow ➕ comment 💰💰

💵💵💵💵💵💵💵💵💵💵💵💵

View OriginalPlease note! ⚠️⚠️⚠️

New fans, friends, "Welcome to subscribe and obtain the wealth code"

Hardcore fans, please like 💞 follow ➕ comment 💰💰

💵💵💵💵💵💵💵💵💵💵💵💵

Subscribers Only

Subscribe now to view exclusive content- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

hardcore fan strategy order!⚠️

Please note! ⚠️⚠️⚠️

New fans, welcome to start your subscription to get the wealth password.

hardcore fan babies, actively like 💞 follow ➕ comment 💰💰

💵💵💵💵💵💵💵💵💵💵💵💵

View OriginalPlease note! ⚠️⚠️⚠️

New fans, welcome to start your subscription to get the wealth password.

hardcore fan babies, actively like 💞 follow ➕ comment 💰💰

💵💵💵💵💵💵💵💵💵💵💵💵

Subscribers Only

Subscribe now to view exclusive content- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

#晒出我的持仓收益# Everyone pay attention, when the Long Wick Candle goes down, move directly to the target position nearby, do not hesitate.

View Original

- Reward

- like

- Comment

- Repost

- Share

hardcore fan strategy order!⚠️

Please note! ⚠️⚠️⚠️

New fans, welcome to subscribe to obtain the wealth password.

Hardcore fan babies, actively like 💞 follow ➕ comment 💰💰

💵💵💵💵💵💵💵💵💵💵💵💵

View OriginalPlease note! ⚠️⚠️⚠️

New fans, welcome to subscribe to obtain the wealth password.

Hardcore fan babies, actively like 💞 follow ➕ comment 💰💰

💵💵💵💵💵💵💵💵💵💵💵💵

Subscribers Only

Subscribe now to view exclusive content- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- 1

- Repost

- Share

On-chainEvangelistJack :

:

pi decentralization head exchange pijs Currently, the early construction is at the low-price chip stage

Holding 200 for five years could potentially yield k or k times

Just the cost of a meal and

Holding for five years could yield k times is 200k, k times is 2M

A very good opportunity for a bottom-level turnaround.

- Reward

- like

- Comment

- Repost

- Share