More

- Topic1/3

10k Popularity

2k Popularity

14k Popularity

22k Popularity

15k Popularity

- Pin

- 🎊 ETH Deposit & Trading Carnival Kicks Off!

Join the Trading Volume & Net Deposit Leaderboards to win from a 20 ETH prize pool

🚀 Climb the ranks and claim your ETH reward: https://www.gate.com/campaigns/site/200

💥 Tiered Prize Pool – Higher total volume unlocks bigger rewards

Learn more: https://www.gate.com/announcements/article/46166

- 📢 ETH Heading for $4800? Have Your Say! Show Off on Gate Square & Win 0.1 ETH!

The next bull market prophet could be you! Want your insights to hit the Square trending list and earn ETH rewards? Now’s your chance!

💰 0.1 ETH to be shared between 5 top Square posts + 5 top X (Twitter) posts by views!

🎮 How to Join – Zero Barriers, ETH Up for Grabs!

1.Join the Hot Topic Debate!

Post in Gate Square or under ETH chart with #ETH Hits 4800# and #ETH# . Share your thoughts on:

Can ETH break $4800?

Why are you bullish on ETH?

What's your ETH holding strategy?

Will ETH lead the next bull run?

Or any o

- 🧠 #GateGiveaway# - Crypto Math Challenge!

💰 $10 Futures Voucher * 4 winners

To join:

1️⃣ Follow Gate_Square

2️⃣ Like this post

3️⃣ Drop your answer in the comments

📅 Ends at 4:00 AM July 22 (UTC)

- 🎉 [Gate 30 Million Milestone] Share Your Gate Moment & Win Exclusive Gifts!

Gate has surpassed 30M users worldwide — not just a number, but a journey we've built together.

Remember the thrill of opening your first account, or the Gate merch that’s been part of your daily life?

📸 Join the #MyGateMoment# campaign!

Share your story on Gate Square, and embrace the next 30 million together!

✅ How to Participate:

1️⃣ Post a photo or video with Gate elements

2️⃣ Add #MyGateMoment# and share your story, wishes, or thoughts

3️⃣ Share your post on Twitter (X) — top 10 views will get extra rewards!

👉

[Japan] The core CPI in June 2025 rose by 3.3% compared to the same month last year, with growth slowing from the previous month | A clear explanation of important economic indicators of Japan and America | Manekuri Monex Securities' investment information and media useful for money.

Announcement on July 18, 2025 (Friday) at 8:30

Japan Consumer Price Index (National) June 2025

【1】Results: The gasoline subsidy contributes to the decline in energy, with only a slight acceleration in core-core growth.

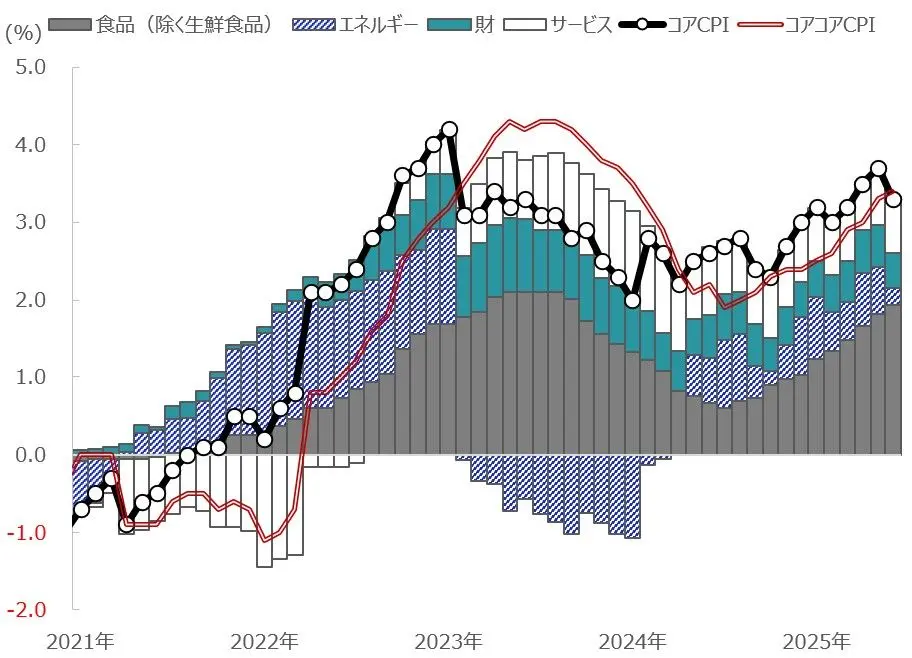

[Figure 1] Results of the National Consumer Price Index in June 2025 Source: Created by Monex Securities from the Ministry of Internal Affairs and Communications

The national consumer price index for June 2025 showed that the headline composite index rose 3.3% year-on-year, marking a 0.2 point decrease from the previous month of May, which was in line with market expectations.

Source: Created by Monex Securities from the Ministry of Internal Affairs and Communications

The national consumer price index for June 2025 showed that the headline composite index rose 3.3% year-on-year, marking a 0.2 point decrease from the previous month of May, which was in line with market expectations.

[Figure 2] Contribution decomposition of Core CPI (Year-on-Year, %, percentage points) Source: Created by Monex Securities, Ministry of Internal Affairs and Communications

The overall index excluding fresh food (core CPI) rose by 3.3% year-on-year, marking the first deceleration in growth in four months. As shown in Chart 2, while food prices remain high, the reduction in gasoline taxes has contributed to a decrease in energy prices.

Source: Created by Monex Securities, Ministry of Internal Affairs and Communications

The overall index excluding fresh food (core CPI) rose by 3.3% year-on-year, marking the first deceleration in growth in four months. As shown in Chart 2, while food prices remain high, the reduction in gasoline taxes has contributed to a decrease in energy prices.

Food prices show signs of decline due to the distribution of stored rice at the grassroots level, but in June, there was a 100.2% increase compared to the same month last year, which is a slowdown from the previous 101.7%, yet it still represents a high growth rate. Additionally, the core-core CPI, excluding highly volatile fresh food and energy, accelerated with an increase of 3.4%, making it the only one among the three indices to speed up. Adjusted for seasonal variations, it rose by 0.4% compared to the previous month, indicating significant growth outside of highly volatile items.

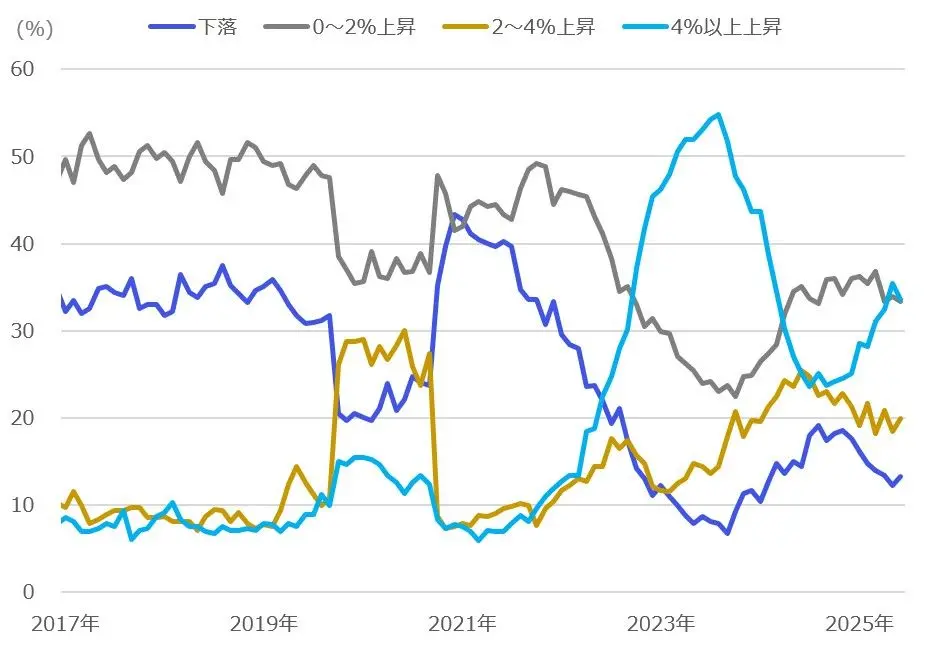

[Chart 3] Core CPI Components: Percentage of Items with Year-on-Year Increases and Decreases (by Range, %) Source: Created by Monex Securities from the Ministry of Internal Affairs and Communications

Looking at the rising and falling items, in May, out of the 522 items that make up the core CPI, 417 items increased, 36 items decreased, and 69 items remained unchanged. There is a sense of peak out in the share of items that increased by more than 4%, indicating signs that high inflation items are beginning to stabilize.

Source: Created by Monex Securities from the Ministry of Internal Affairs and Communications

Looking at the rising and falling items, in May, out of the 522 items that make up the core CPI, 417 items increased, 36 items decreased, and 69 items remained unchanged. There is a sense of peak out in the share of items that increased by more than 4%, indicating signs that high inflation items are beginning to stabilize.

【2】Content and Highlights: The service continues on an upward trend.

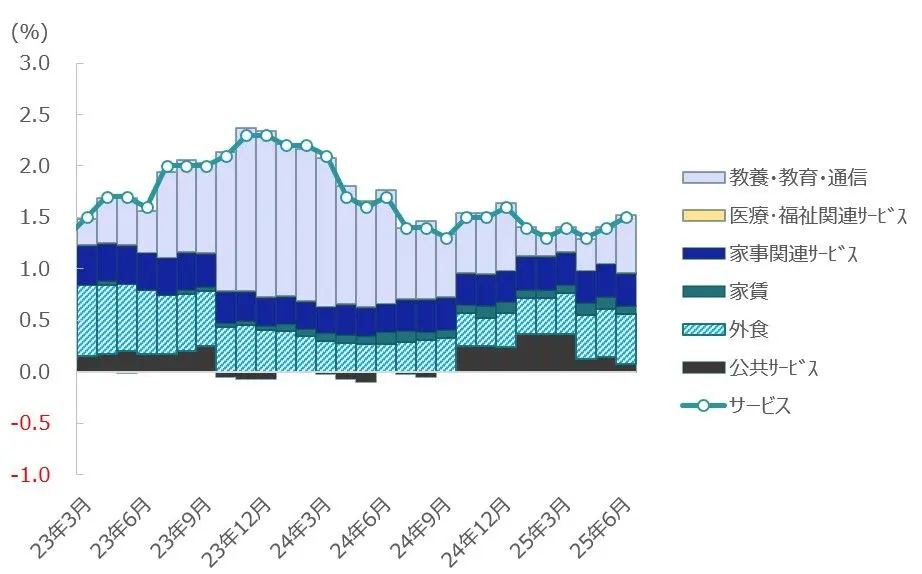

[Figure 4] Contribution Decomposition of Service Inflation (Year-on-Year, %, % Points) Source: Created by Monex Securities from the Ministry of Internal Affairs and Communications

The service CPI, which is closely related to labor costs, rose by 1.5% compared to the same month last year, showing a slight acceleration of 0.1 percentage points from May. The increase was contributed by dining out and communication, education, and entertainment services, with growth expanding for two consecutive months.

Source: Created by Monex Securities from the Ministry of Internal Affairs and Communications

The service CPI, which is closely related to labor costs, rose by 1.5% compared to the same month last year, showing a slight acceleration of 0.1 percentage points from May. The increase was contributed by dining out and communication, education, and entertainment services, with growth expanding for two consecutive months.

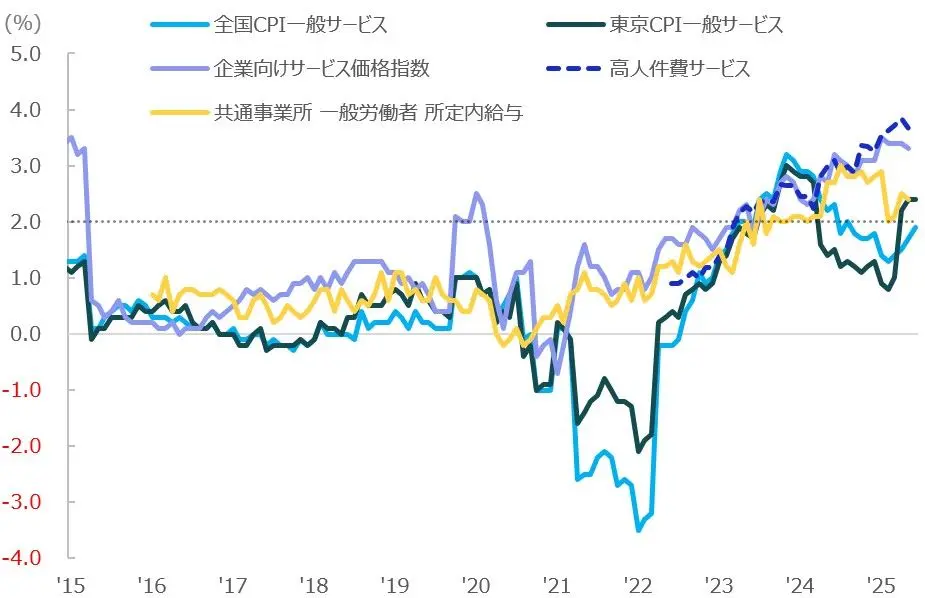

[Figure 5] Trends in Service-Related Wages and Price Indicators (Year-on-Year Comparison, %) Source: Created by Monex Securities from the Ministry of Internal Affairs and Communications, the Bank of Japan, and the Ministry of Health, Labour and Welfare.

The index for general services, which is expected to have a greater impact on wages (composed of dining out and household-related services, education, healthcare services, etc. provided by general enterprises), has risen by 1.9%, close to the 2% increase targeted by the Bank of Japan (see Chart 5 in light blue).

Source: Created by Monex Securities from the Ministry of Internal Affairs and Communications, the Bank of Japan, and the Ministry of Health, Labour and Welfare.

The index for general services, which is expected to have a greater impact on wages (composed of dining out and household-related services, education, healthcare services, etc. provided by general enterprises), has risen by 1.9%, close to the 2% increase targeted by the Bank of Japan (see Chart 5 in light blue).

Regarding this period, it is expected that wage growth will remain solid due to the impact of the spring labor negotiations that concluded with results around 2024. From Chart 5, it can be seen that wage-related indicators have been increasing compared to the past, but the challenge remains to have a stable wage growth rate that exceeds inflation.

The consumer price index for June, used to calculate the conventional real wages (excluding imputed rent for owner-occupied housing), increased by 3.8% compared to the same month last year, reaching a high level. Given that core-core inflation remains elevated, it is pointed out that it may take time for inflation to slow down, and similarly, achieving a positive trend in real wages may also take time.

【3】Impressions: Even if cost-push pressures ease, high inflation may persist.

It seems that the growth of core inflation is accelerating, and even though cost-push inflation is calming down, the service sector is expanding its positive contribution, leading to a feeling of prolonged high inflation. In reality, since the share of food is significant, it is believed that if prices stabilize to levels typical of previous years, inflation will gradually slow down. However, there are reports indicating that farmers are expressing concerns about excessive price declines, and it is quite conceivable that prices may not drop below 3,000 yen for 5 kilograms.

Monex Securities Financial Intelligence Department Keita Yamaguchi