New changes in the crypto power structure: Anchorage’s iron vault

More than a decade after crypto’s explosive beginnings, the Bitcoin halving-driven gold rush is fading. In its place, sporadic liquidity waves from U.S. equities, the dollar, and Treasuries fuel the market, with each cycle defined by its own distinct hotspots—much like Pendle’s journey from fixed income and LST to BTCFi, Ethena, and Boros.

Breaking into the “new money” elite is far harder than managing the assets of the established “old money.”

As custodians like to say: you earn from those who hold the wealth.

In crypto, true deep capital pools come in three forms: individual whales (such as early BTC miners, early ETH investors, and DeFi Summer OGs), on-chain institutions (crypto-native VCs, centralized exchanges, public chains, and select project teams), and the Wall Street powerhouses—both legacy and new entrants.

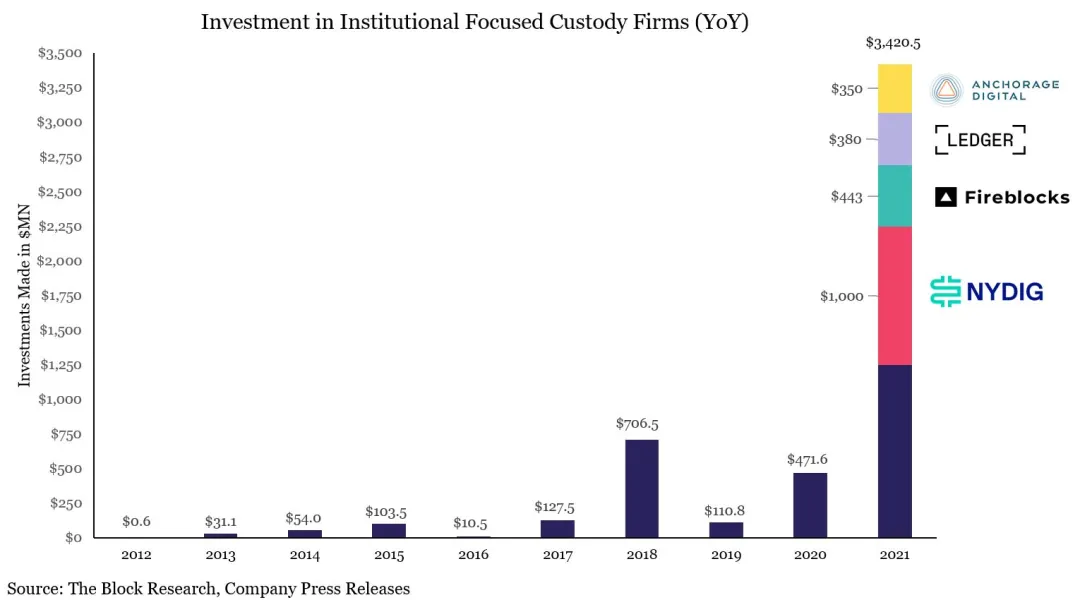

Illustration: Peak Crypto Custody Fundraising

Image Credit: @zuoyeweb3

The custodian sector has split and specialized. After raising $3 billion in 2021, and with the blowups of FTX-Celsius and 3AC-Luna-UST in 2022, the crypto custody landscape largely took shape. Notable players include:

- • Copper, Ceffu, Cobo – servicing on-chain projects

- • Coinbase – ETF custody

- • BNY Mellon – bank-level custody

- • Fireblock – exchange custody

Coinbase in particular has secured the lion’s share of ETF custody, with over 80% of BTC and ETH ETF issuers choosing it as their partner. MicroStrategy (MSTR) also counts Coinbase as its preferred custodian for BTC in its treasury strategy.

The Retail Era Ends—Institutions Now Drive Crypto Wealth

Crypto’s profit models have evolved with the times. In an age of capital concentration, whoever controls the deepest pockets claims the largest profits. Miners, exchanges, and market makers have all had their heyday. Next up: custodians. As traditional finance capital migrates on-chain, funds won’t flow directly to public blockchains or exchanges—they’ll be routed through trusted custodians instead.

Ethereum’s daily transaction volume has exceeded DeFi Summer’s previous peak, hitting 1.74 million. Unlike previous cycles driven by meme coins or trading, this growth is powered by a stablecoin lending loop ignited by Aave and Ethena.

Coincidentally, Aave’s collaboration with Plasma is paving the way for TradFi stablecoins to move on-chain. Yet under the Genius Act, payment stablecoins can’t pay user interest, so once funds are on-chain, they can stagnate, becoming dead weight for issuers.

Meanwhile, as CEXs see shrinking trading volume, custodial, staking, and yield-generating services are emerging as the next big opportunity—especially for banks and other TradFi players. As rate cuts loom, the challenge is how to channel the liquidity tied up in 401(k)s and treasuries onto blockchain rails—a new frontier for startups.

The era of exchange dominance is ending, as on-chain models and IPOs squeeze CEXs from both sides. Hyperliquid is showing potential to surpass Binance, while Kraken and Bullish are lining up to challenge Coinbase’s monopoly as the sole listed exchange.

Strategically, everyone is chasing post-CEX yield. Old money, with its massive capital base, is content with lower yields as long as principal is ultra-safe—hence Tether’s move to build a physical gold vault. On-chain vault solutions are set to become big business too.

In an ETF-led market, Coinbase’s dominance is unlikely to be toppled soon, but shifting market dynamics are opening new doors for second- and third-tier players.

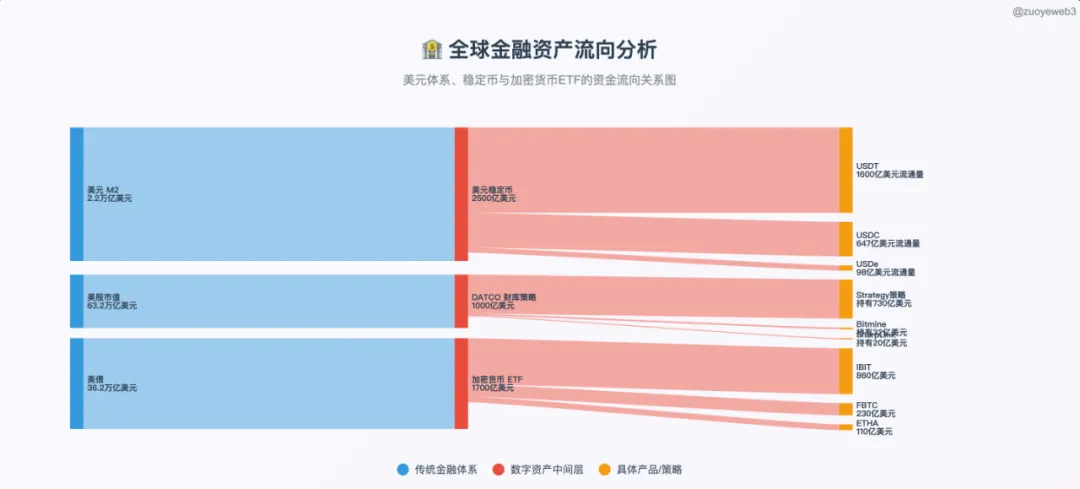

Illustration: TradFi & DeFi Merge

Image Credit: @zuoyeeb3

Compared to the immense wealth creation of the dollar, Treasuries, and U.S. equities, crypto is still in its formative stages—currently “catching the flow in a washbasin.” Only when institutional-grade security and compliance (“bathtub-sized” infrastructure) are in place will liquidity truly flood in.

Veterans are now differentiating. Anchorage Digital and Galaxy Digital stand out as prime examples.

- • Galaxy – Treasury management (DATCO)

- • Anchorage – Stablecoin custody

- • Anchorage Digital & Galaxy Digital – New ETF staking solutions

Outside BTC and spot ETFs, both “Digital” firms are competing for Coinbase’s market share. Let’s explore their shared ambitions.

Two key trends define the spot ETF market: First, increased standardization—altcoins and meme coins (beyond BTC and ETH) could become ETFs after six months on Coinbase derivatives. Second, approval of staking-ETF models, allowing ETF issuers to redeem underlying assets and integrate with on-chain staking.

One example: Anchorage Digital is the exclusive custodian and staking partner for REX-Osprey’s Solana Staking ETF, perfectly aligning with both trends. If the bull run continues, ETF products will be a major growth area for Anchorage Digital.

In traditional ETFs, Anchorage now partners with 21Shares and BlackRock. It also serves as custodian for Trump Media’s Bitcoin treasury—its reach even extending into Mar-a-Lago.

Anchorage: Building a Stablecoin Fortress and Crypto’s Fort Knox

In 2019, Anchorage began working with Visa, and by 2021 had become Visa’s USDC settlement agent bank.

2021 was pivotal: Anchorage launched its crypto custody business with a $3 billion valuation, received an OCC crypto bank charter, and became the digital asset custodian for the U.S. Marshals Service.

In 2022’s crypto crash, Anchorage emerged as Aptos’s preferred custodian (with co-founder Diogo Mónica also investing in Aptos).

By Q1 2023, platform assets had grown 80%, yet the firm laid off 75 employees (20%) and publicly called for stablecoin regulation.

In 2024, co-founder Diogo Mónica stepped back from daily management, leaving Nathan McCauley fully in charge.

2025 will see Anchorage Digital take over as custodian for Trump Media’s Bitcoin treasury, alongside acquiring USDM issuer Mountain Protocol.

Anchorage Digital, founded in 2017 by Nathan McCauley and Diogo Mónica, started as a small South Dakota trust but got a lucky break in 2021, becoming the sole recipient (to date) of the OCC’s crypto bank charter.

Whether in Silicon Valley, Wall Street, or Washington, exclusive financial services always come down to relationships and connections.

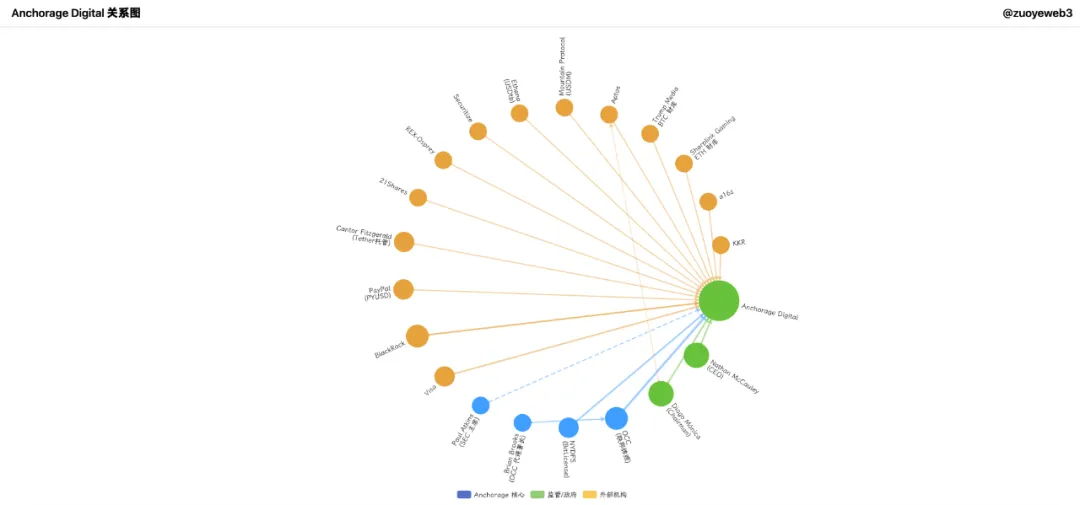

Illustration: Anchorage Digital’s Institutional Network

Image Credit: @zuoyeweb3

Anchorage Digital has developed a comprehensive institutional suite: trading, derivatives, clearing, staking, and custody. Think of it as a one-stop crypto shop for institutions. But unlike Galaxy, Anchorage is staking its future on stablecoins.

The first chapter in Anchorage’s story is all about timing: In 2021, with crypto-skeptical Democrat Joe Biden entering the White House, and millions from SBF supporting his campaign, Brian Brooks (ex-Coinbase CLO) became Acting Comptroller of the OCC.

Brooks pushed for crypto-friendly banking policies, launching “Project REACh” to promote fintech access and non-discrimination for crypto companies.

Anchorage seized the moment, transforming from a local trust to Anchorage Digital Bank—becoming a true national bank.

On January 13, 2021, Anchorage Digital Bank received approval to accept USD deposits and provide crypto custody services.

One day later, Brooks resigned. Thanks to this twist of fate, Anchorage remains the only OCC-licensed crypto bank in existence.

This charter is featured prominently across all Anchorage Digital products and helped the firm land $430 million in Series C and D funding—enough to weather the crypto winter and position itself for the coming stablecoin boom.

Anchorage’s investors include crypto VCs like a16z as well as Wall Street titans KKR and BlackRock.

For context, Bitpay and Paxos also applied for banking charters but were denied; Paxos was recently fined $26.5 million by New York DFS for BUSD compliance issues.

Anchorage holds both an OCC national crypto bank charter and a New York BitLicense, making its regulatory credentials second only to BNY Mellon.

Although Anchorage clashed with the OCC after Brooks’s departure, it has remained uniquely licensed—and that license is an enduring asset.

Anchorage’s regulatory status enables it to custody everything from stablecoin reserves to digital assets and even NFTs. But the 2022 crash triggered internal turbulence, especially a shake-up among founders.

Diogo Mónica moved to Hanu Ventures as a partner (while staying on as Anchorage Digital’s Executive Chairman, focusing on talent and strategy). Nathan McCauley fully took charge of business operations, ramping up efforts to deepen ties with BlackRock and expand stablecoin services.

Anchorage now serves as custodian for 21Shares’ Bitcoin and Ethereum spot ETFs and is the exclusive custodian and staking partner for REX-Osprey’s Solana Staking ETF.

Anchorage is also active outside of ETFs—partnering with Visa for stablecoin payments and introducing compliant stablecoins like Paypal’s PYUSD to institutional clients.

Notably, Anchorage also provides custody services to Tether’s custodian and investor, Cantor Fitzgerald, becoming custodian to the Tether custodian.

For all its regulatory firepower, Anchorage was underwhelming prior to 2025—sporting a $3 billion valuation and $50 billion in assets under custody, but struggling to compete with Coinbase on ETFs. Its real focus has shifted to stablecoins.

The key: Anchorage Digital Bank NA (its North American branch) can accept both dollars and stablecoin deposits, offering custody services for both.

- • Off-chain: Partnering with Ethena to scale the issuance of USDtb, ensuring compliance under the Genius Act

- • On-chain: Forming the USDG Stablecoin Alliance with Paxos and Kraken to jointly operate the Global Dollar Network

Anchorage is also active in treasury strategy: Joseph Chalom, a former BlackRock executive, joined ETH treasury firm Sharplink Gaming as co-CEO and helped facilitate the BlackRock-Anchorage ETF custody partnership.

BlackRock’s BUIDL fund is closely linked to Chalom, with Anchorage as custodian. The equation:

$BUIDL = BlackRock (issuer) = Securitize (tokenization tech) + Anchorage Digital (custody) + BNY (cash services)

Even more intriguingly, SEC Chair Paul Atkins holds at least $250,000 in Anchorage Digital equity and is a shareholder in Securitize, which is partnered with Ethena to co-issue Converage.

With Galaxy now public, there’s talk that Anchorage Digital could pursue its own IPO. As its stablecoin business grows, so will its appetite for capital—possibly making it crypto banking’s first IPO this year.

Galaxy Digital: Ascending to the Throne of Treasury Management

Compared to Anchorage Digital, Galaxy stands out for its profile—not just as Goldman Sachs’ OTC crypto pilot partner in 2022, but as a key exit venue for Bitcoin whales. Its reach extends to BTC mining, venture investing, AI compute, and more, with founder Mike Novogratz commanding an even wider network than Anchorage’s leadership.

On July 25, Galaxy helped an early miner liquidate roughly 80,000 BTC ($9 billion). Even though the sales were staggered, the news alone caused Bitcoin’s price to drop nearly 4% below $115,000.

Such large trades have prompted speculation about market manipulation, but Galaxy’s institutional focus means its incentives align with market stability and growth—unlike aggressive market makers.

But Galaxy’s real edge is timing: founder Mike Novogratz, a veteran finance professional, has always approached crypto pragmatically—not out of ideology, but as a business opportunity.

As retail investors fade and institutions move in, Galaxy’s expansion—especially in treasury strategies—is increasingly worth watching.

Recall the ETH treasury firm Sharplink, now led by a former BlackRock exec?

In June 2025, Sharplink made repeated OTC ETH purchases from Galaxy, tallying at least $800 million—no surprise, since Galaxy is also a Sharplink investor. It’s a clear example of “one hand sells to the other.”

Beyond BTC and ETF business, Galaxy has invested in and helped build Ethena’s Stablecoinx treasury solution and Mill City Ventures III, Ltd., which manages a $450 million SUI treasury.

Galaxy is also expanding its OTC offerings, supporting LST LsETH for Liquid Collective, with the SOL version (lsSOL) aimed at institutions and supported by Anchorage Digital.

Again, this is a tightly interwoven industry.

Moreover, the Global Dollar Network now includes both Anchorage Digital and Galaxy Digital—showing that, for major custodians, collaboration often trumps cutthroat competition.

Whereas Anchorage is focused on stablecoins and regulatory advantages, Galaxy remains primarily oriented toward treasury management, continuing to develop non-BTC/ETH treasury solutions.

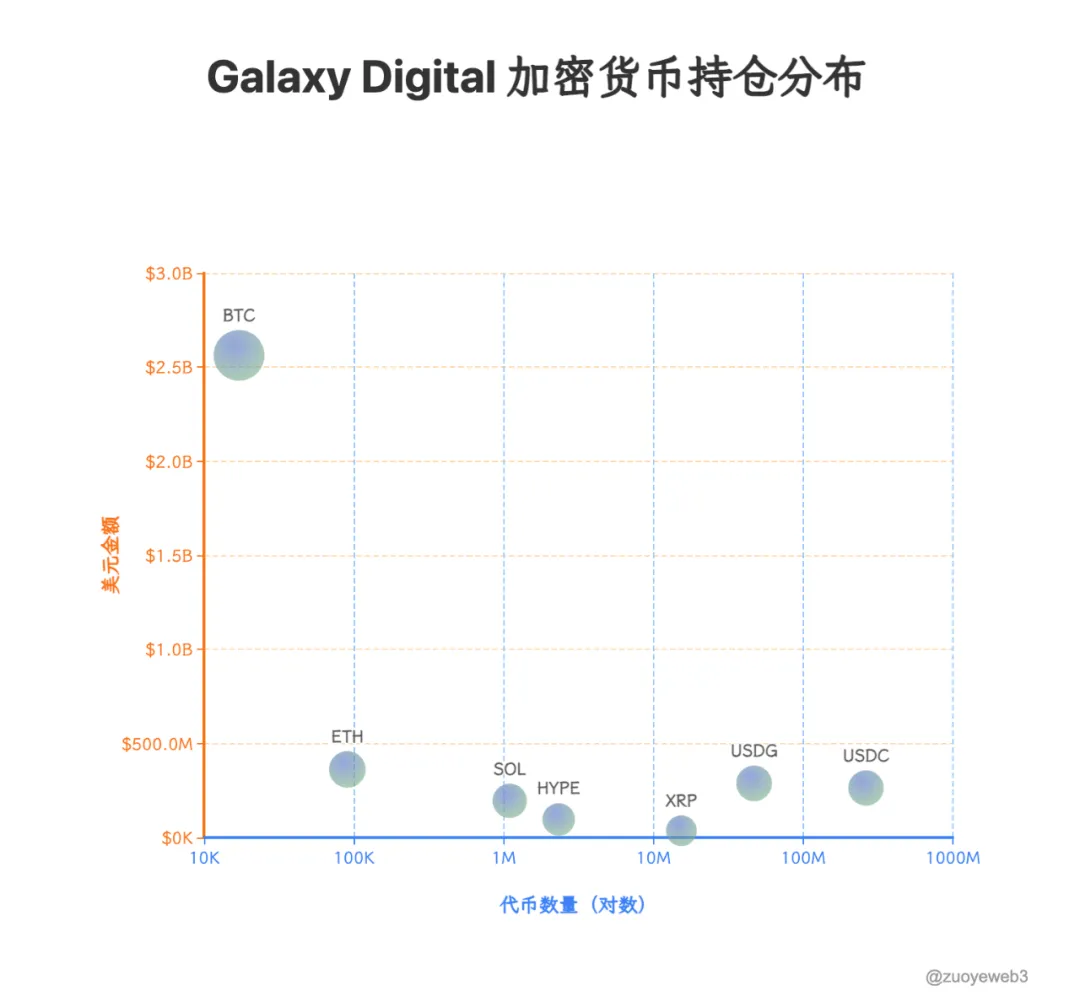

With ample capital, Galaxy holds $1.8 billion in BTC and has recently built a $34.4 million position in Ripple (XRP). In an ironic twist, Ripple just acquired Galaxy-backed stablecoin startup Rail for $200 million.

Once more, it’s a “left hand to right hand” transaction.

Galaxy’s reports point to future treasury and market-making priority: $HYPE, $SOL, and $XRP. With Ripple resolving its SEC dispute and surging 10% in one session, Galaxy is moving ahead of retail.

Illustration: Galaxy Digital Holdings

Image Credit: @zuoyeweb3

Data Source: @SECGov

Galaxy has fully exited from UNI and TIA. In this new era, yesterday’s stars are out; USDG, HYPE, and XRP are the new winners—OTC desks always sense the water’s temperature first.

Historically, OTC desks passively filled whale orders without influencing spot markets—a sharp difference from exchange market makers. Treasury strategies are changing this: as tokens, equities, and bonds integrate, who calls the shots on token prices remains up for grabs.

Conclusion

Custodians have become the crossroads of capital—off-chain assets require secure on-chain migration, while on-chain liquidity needs compliant off-ramps. With treasury strategies, custodians can actively influence token prices. Crypto liquidity is the real power structure; the CEX/MM era is fading fast.

BNY Mellon holds over $52 trillion in custodial assets; in contrast, all of crypto is less than $4 trillion in market cap, with stablecoins, crypto ETFs, and treasury firms totaling just $520 billion. Crypto custodians have room to grow before they can flex real market power.

Still, every founder must remember: the money always follows the greatest profit opportunities.

Disclaimer:

- This article is reproduced from [Zuoye Waiboshu] and remains the intellectual property of the original author [Zuoye Waiboshu]. For reprint concerns, please contact the Gate Learn team and they will take prompt action as appropriate.

- Disclaimer: The views and opinions expressed herein are solely those of the author and do not constitute investment advice.

- Other language versions were translated by the Gate Learn team. Unless Gate is cited as the source, these are not to be copied, distributed, or plagiarized.

Related Articles

Solana Need L2s And Appchains?

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What Is Ethereum 2.0? Understanding The Merge