Gate Research: Funding Dips to $3.68B as Capital Shifts to Growth Projects and Crypto Reserves | July 2025 Web3 Fundraising Overview

This report summarizes the Web3 industry’s fundraising activity in July 2025. A total of 132 funding deals were completed during the month, with an aggregate amount reaching $3.68 billion. Capital primarily flowed into CeFi and blockchain services, reflecting a dual focus on infrastructure and services. Investment was concentrated in growth-stage projects raising between $3 million and $20 million, with Series A rounds emerging as the main battleground for capital. Meanwhile, the accelerated adoption of traditional financial instruments such as Post-IPO deals signals a deepening integration between the Web3 industry and mainstream capital markets.The report also highlights key fundraising projects including Delabs Games, Gaia Labs, Syntetika, Blockskye, and Limitless.Summary

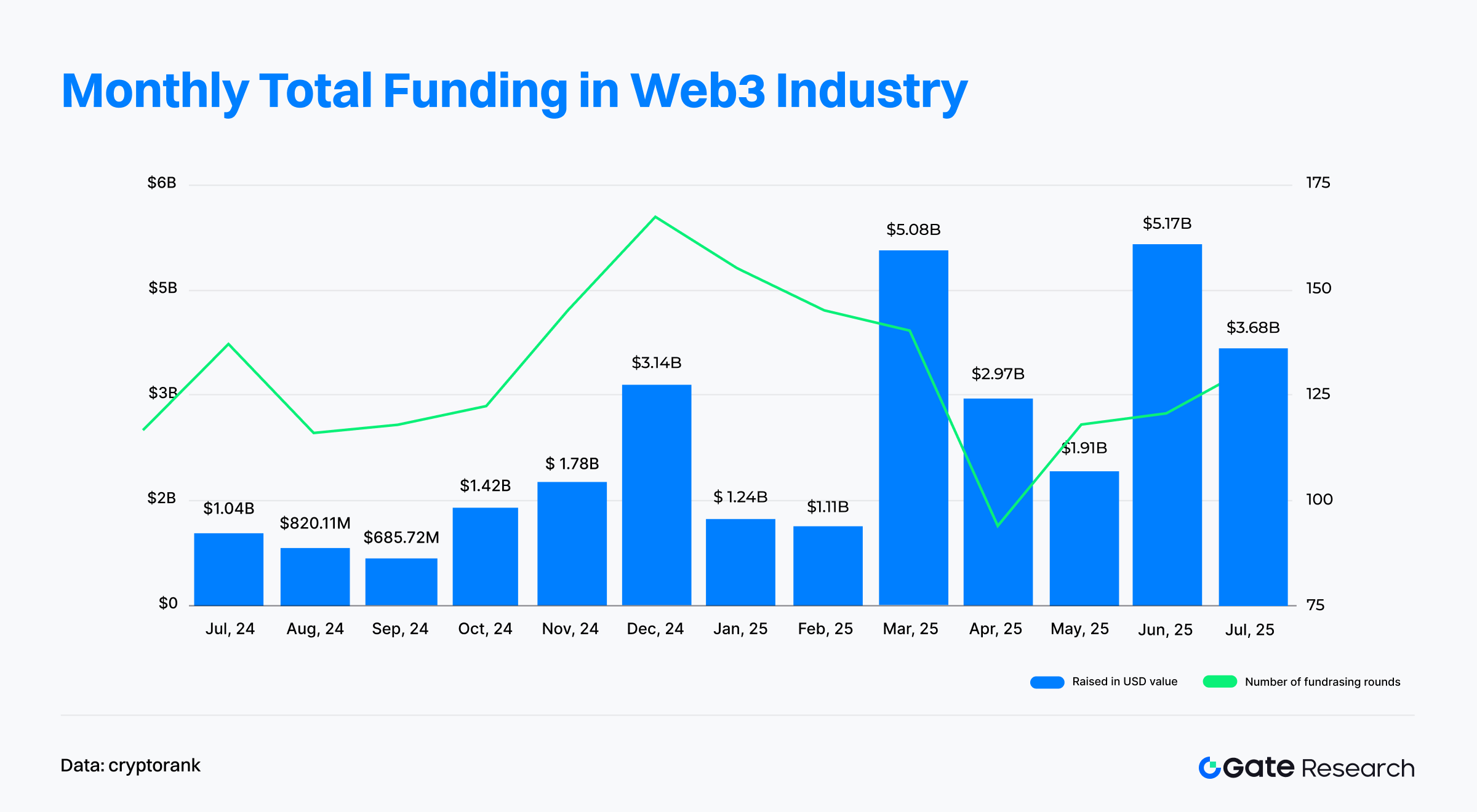

- According to data released by Cryptorank Dashboard on August 5, 2025, the Web3 sector recorded 132 fundraising deals in July 2025, with a total fundraising amount of $3.68 billion, continuing the strong momentum in capital inflows.

- Among the Top 10 fundraising deals, the landscape revealed a clear trend of capital concentration and institutionalization. Traditional financial instruments such as Post-IPO and PIPE (Private Investment in Public Equity) rounds have become increasingly mainstream, signaling a deepening integration between Web3 and traditional capital markets.

- A growing number of projects explicitly stated that a portion of their raised funds would be allocated to purchasing BTC, ETH, SOL, and other major crypto assets for treasury reserves — a trend that is becoming the new norm across the industry.

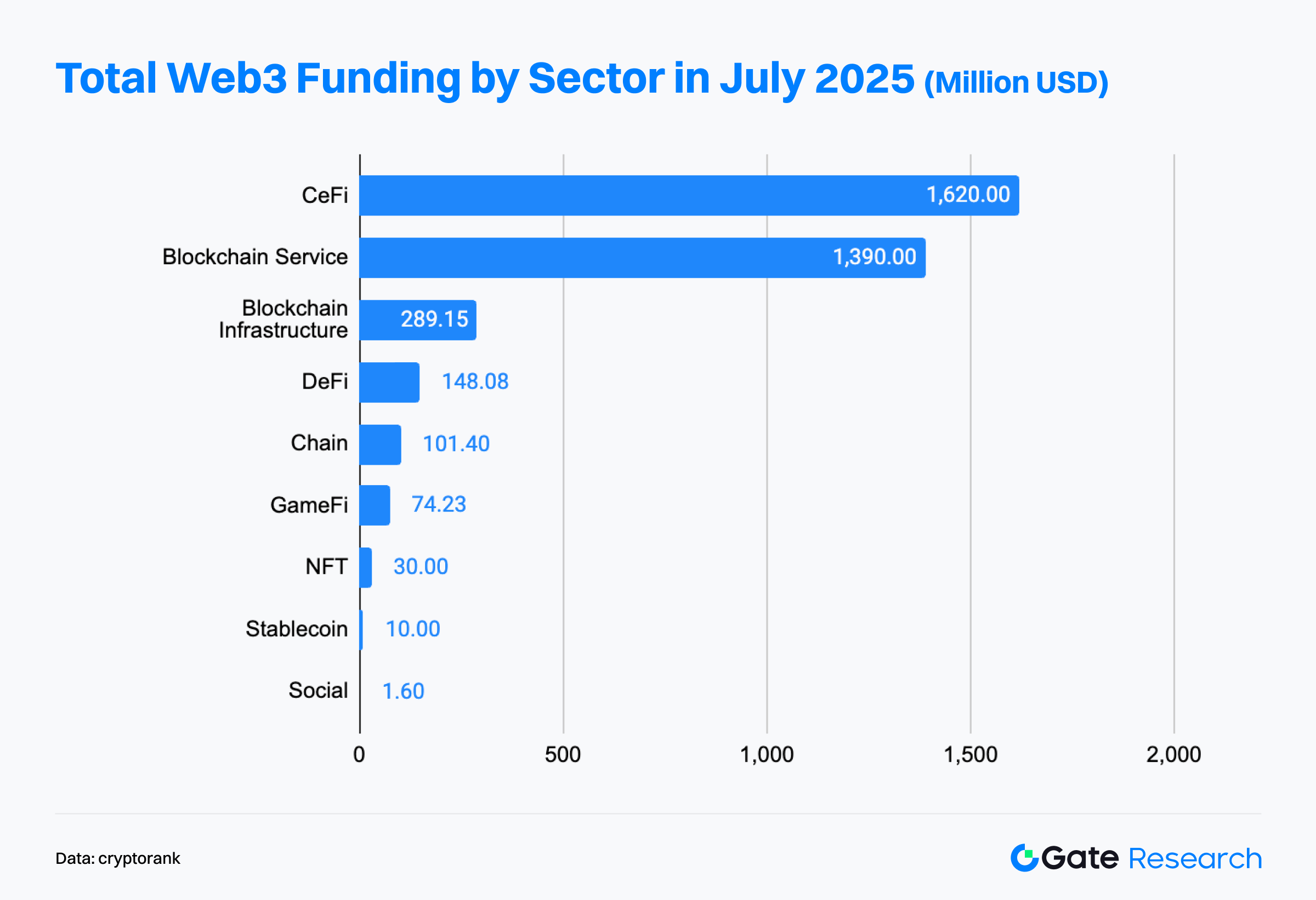

- Fundraising activity was largely concentrated in CeFi ($1.62B) and blockchain services ($1.4B), reflecting a structural trend of “infrastructure first, services-driven, and application-specific diversification.” Capital continues to favor centralized service platforms that can bridge Web2 and Web3 and demonstrate full commercial loop capabilities.

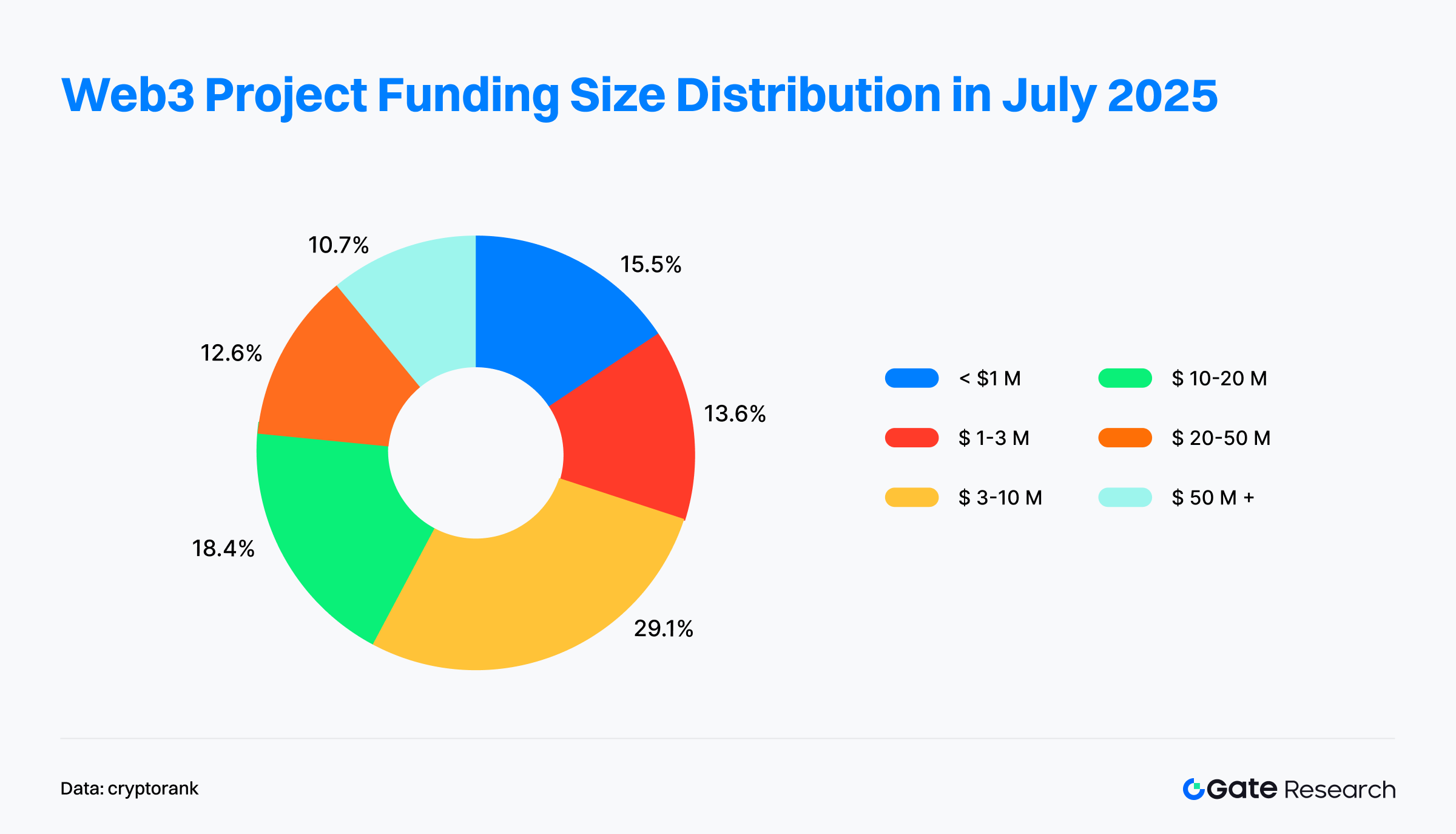

- In terms of funding size, growth-stage projects in the $3M–$20M range attracted the majority of capital, accounting for 47.5% of total deals. These projects typically fall in the late Product-Market Fit (PMF) phase and are preparing for market expansion, making them a core focus for investors.

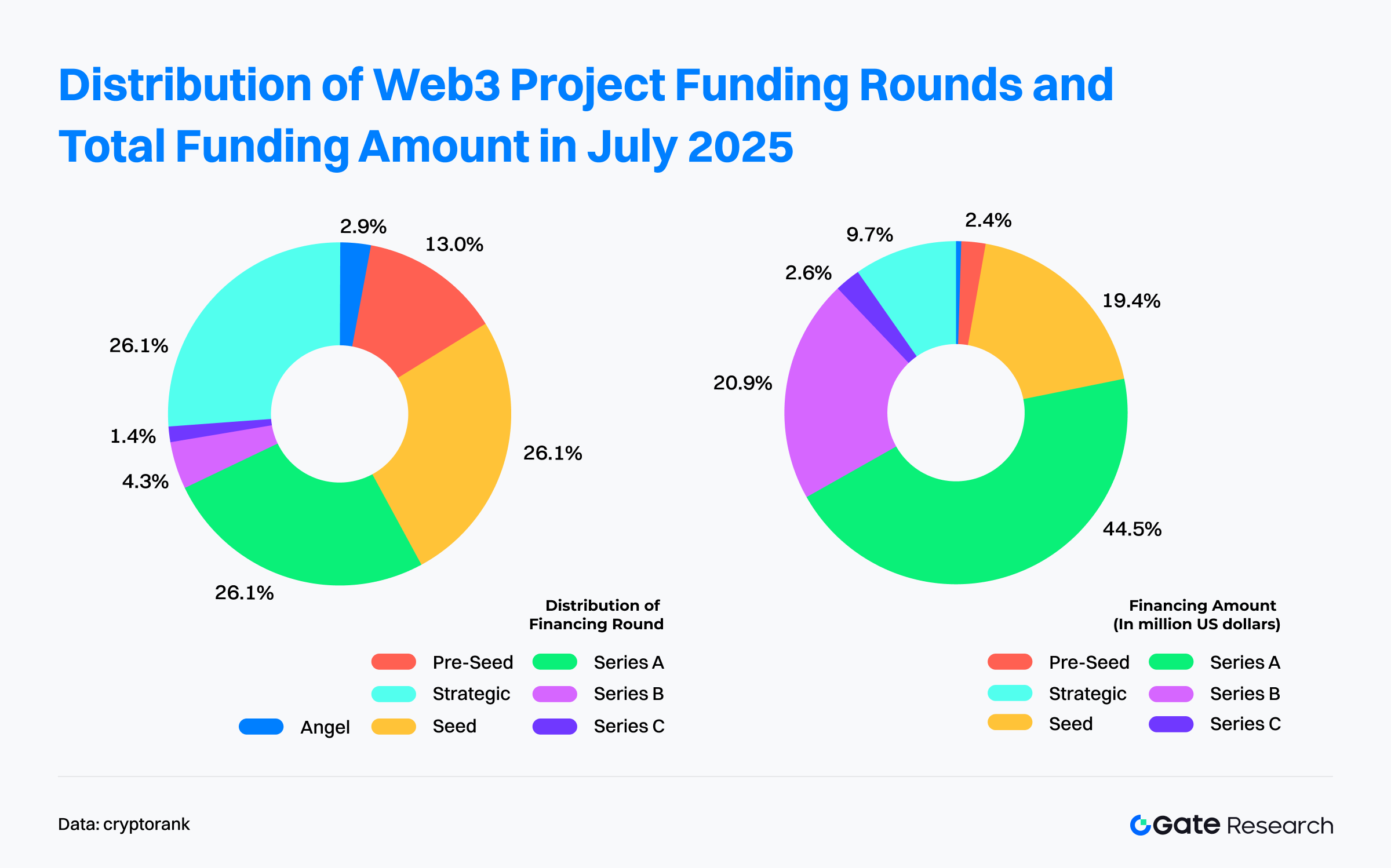

- By funding stage, growth rounds dominated, with Series A alone contributing 44.4% of total funding, indicating a shift in investor preference from narrative-driven to growth-validated projects with clear go-to-market strategies, technological maturity, and commercialization potential.

- At the investor level, Colosseum was the most active fund in July, participating in 9 deals.

Financing Overview

According to Cryptorank’s data published on August 5, 2025, the Web3 sector saw 132 fundraising deals in July, totaling $3.68 billion in capital raised.【1】Due to differences in Cryptorank’s statistical methodology, this figure differs slightly from the sum of individual disclosed deals (approximately $3.77 billion). To ensure consistency, this report uses the original dashboard data.

Compared to June 2025, which saw 119 deals and $5.14 billion in funding, July saw a 10.92% increase in deal count, but a 28.4% decline in total amount raised. This phenomenon — more deals, less capital — was primarily due to the unusually large rounds in June, particularly in regulated financial services, listed company expansions, and deep integration with traditional finance. Notably, Circle’s $1.1B IPO topped the June list, and there were five mega-rounds exceeding $400M. In contrast, July had only two rounds over $400M, the largest being MARA’s $900M Post-IPO financing on July 28 — still smaller than June’s peak.

Looking at 2025 year-to-date trends, fundraising cooled slightly at the start of the year, with January and February both staying in the $1B–$1.2B range. However, the market quickly regained momentum, with March surpassing $5B and June hitting a two-year high of $5.17B, characterized by concentration, scale, and institutional dominance — all signs of a maturing market.

Although July saw a pullback in fundraising volume, overall activity remained strong. The sustained high deal count and continued capital deployment reflect robust market confidence. The Web3 sector is clearly entering a new phase marked by accelerated capital allocation and structural evolution.

In July 2025, the Top 10 fundraising projects in the Web3 sector demonstrated a clear trend toward capital concentration and institutionalization. These top deals collectively raised a total of $2.75 billion, with most individual rounds exceeding $100 million, significantly boosting the overall market performance.

Leading the list was MARA, which secured $950 million through a Post-IPO convertible debt deal, showcasing the strong fundraising capability of crypto mining firms in capital markets. This was followed by Mill City Ventures III, which raised $450 million via a PIPE (Private Investment in Public Equity) round, with the funds earmarked for building a Sui treasury—signaling traditional finance’s continued interest in and deeper participation in public blockchain ecosystems.【2】

From a round-type perspective, Post-IPO and PIPE deals emerged as mainstream, collectively accounting for over 60% of the top projects, especially concentrated in CeFi and blockchain services. This indicates that listed or pre-IPO companies remain key targets for capital and underscores the growing convergence between Web3 and traditional finance. Moreover, several projects explicitly stated their intention to allocate raised funds toward purchasing major crypto assets like BTC, ETH, and SOL as treasury reserves, reinforcing confidence in the long-term value of crypto assets and their role in corporate financial strategies.

Additionally, July also saw the inclusion of a significant M&A deal—QCEX’s acquisition by Polymarket, as well as a traditional Series B round in which TWL Miner raised $95 million. These deals introduced new dynamics and growth drivers into the market.

The Web3 fundraising market in July 2025 exhibited a combination of strong capital inflows, high concentration, and a clear preference for mainstream crypto assets. These signals point to an industry entering a more mature phase, led by top-tier projects and stabilizing capital structures.

According to Cryptorank Dashboard, the month’s fundraising data reflected key trends: institutional dominance, regulatory alignment, and a focus on infrastructure. CeFi and blockchain services together accounted for over 70% of the total monthly fundraising amount—demonstrating capital’s growing preference for platforms that bridge traditional finance with the crypto world, offering both compliance and usability.

The CeFi sector led with $1.62 billion in fundraising, driven by multiple PIPE, Post-IPO, and M&A deals. The funding landscape here was characterized by institutional dominance and a strong top-tier presence. Exchanges, custodians, and crypto asset management platforms remained key areas of investment, viewed as the core gateways for onboarding traditional users and capital into the Web3 space.

The blockchain services sector attracted nearly $1.4 billion in funding. Often described as the “arms dealers” of the Web3 ecosystem, this sector includes API providers, data analytics platforms, node services, and security audit firms. As Web3 infrastructure grows increasingly complex, capital favors specialized, high-efficiency developer tools and enterprise-grade services, which are seen as critical for driving both maturity and mass adoption.

While blockchain infrastructure and Chain raised comparatively less—$289 million and $101 million respectively—the continued flow of capital shows investors still value the long-term potential of base-layer technologies. These investments aim to address core challenges such as scalability, security, and interoperability, laying a stronger foundation for the entire Web3 ecosystem.

Compared to the enthusiasm around infrastructure and centralized platforms, decentralized applications (dApps) saw more tempered and fragmented investment:

- DeFi raised approximately $148 million, accounting for just 4% of total funding. Following earlier hype and associated risks, investor sentiment has become more cautious, with funding now targeting projects with sustainable business models and robust risk management.

- GameFi and NFTs raised a combined $104 million, reflecting a clear cooling-off in these once-hyped sectors. Investors are now placing more weight on real user engagement and sustainable economic models.

- The social sector drew just $1.6 million, highlighting persistent challenges in user acquisition and monetization.

- The stablecoin sector, though raising only $10 million, is regaining investor attention amid increasing regulatory clarity, with related application ecosystems beginning to take shape.

Overall, The fundraising landscape of July 2025 paints a clear picture: infrastructure comes first, services dominate, and applications are selectively funded. Capital is increasingly concentrated in centralized platforms that offer full commercial loops and bridge Web2 and Web3, while infrastructure projects continue to receive strong support as foundational enablers.

Meanwhile, C-facing decentralized applications still hold potential, but investor enthusiasm has notably cooled, entering a phase of rational selection. This marks a shift in Web3 from its early experimental phase toward a more mature, commercialization-driven development cycle.

According to data from 103 Web3 fundraising deals disclosed in July 2025, the overall investment landscape shows a growing preference for mid-stage growth projects—those with clear paths to expansion and real-world application capabilities.

The most active deals fell in the $3 million to $10 million range, accounting for 29% of the total. These typically represent Series A or B rounds, suggesting that a large number of Web3 projects have already passed the Product-Market Fit (PMF) phase and are now seeking capital to scale teams and ecosystems. This stage has attracted the strongest investor interest.

Combining the $3M–10M and $10M–20M ranges, these mid-stage rounds made up 47.5% of the total—highlighting the market’s prevailing theme: “investing for growth.” Investors are increasingly backing projects that have demonstrated initial traction and validated business models to help them build competitive advantages and race toward market leadership.

Meanwhile, large deals exceeding $20 million remained active, representing over 22% of total deals (including rounds of $50M+). These funds were mainly directed at leading CeFi companies, publicly listed firms, or M&A deals, underlining capital’s continued confidence in market leaders and Web3–TradFi integration.

By contrast, early-stage deals below $1 million accounted for 15.5%, and those in the $1M–3M range made up 13.6%. This indicates that while the market has grown more rational and early-stage fundraising has become more challenging, new teams and innovative ideas continue to emerge—injecting fresh momentum into the long-term development of the Web3 ecosystem.

In summary, July’s Web3 fundraising market shows a classic “olive-shaped” structure: smaller share at both ends, larger in the middle.

- Early-stage innovation fuels ecosystem vitality

- Top-tier projects anchor market confidence

- But the core of capital allocation is clearly concentrated in $3M–$20M growth-stage deals

The prevailing investment logic is also shifting—from “telling stories” to “delivering growth.” Capital now favors teams that have already taken shape and show scalable, sustainable business models.

Based on data from 67 Web3 fundraising deals in July 2025 with disclosed round types, a clear pattern emerged: “Active growth-stage rounds, with capital heavily concentrated in Series A.”

- By number of deals, Seed, Series A, and Strategic rounds were the most active, each accounting for around 26.1%, reflecting sustained interest in early-stage innovation and ecosystem-driven collaboration, alongside a sharp focus on validated growth-stage projects.

- By capital allocation, Series A stood out as the dominant round, absorbing 44.4% of total monthly funding. This indicates that capital is increasingly focused on projects that have completed PMF and are poised for rapid scaling. Series B captured an additional 20.9%, meaning Series A + B together accounted for over 65% of total funding—clearly signaling that investor preference is shifting toward mature, mid-to-late-stage ventures.

In contrast, early-stage rounds (Angel and Pre-Seed), though representing nearly 16% of total deals, accounted for less than 3% of total funding. This reveals an ongoing “high-frequency, low-ticket” strategy for early-stage investment, with higher selection thresholds for quality.

Strategic rounds matched Seed and Series A in terms of deal count, but only accounted for 9.7% of capital. This suggests that such rounds are ecosystem- or partnership-driven, usually involving small, strategic checks rather than mainstream financial backing.

While most deals had defined round types, a significant portion fell under “Undisclosed” rounds. These include PIPE (Private Investment in Public Equity) and Post-IPO deals—financing tools more common in traditional capital markets—further showing Web3’s integration with conventional funding mechanisms.

Notably, several of these undisclosed rounds explicitly stated that funds would be used to purchase BTC, ETH, or SOL as treasury reserves. Although such financial allocation-focused rounds were not included in Cryptorank Dashboard’s standard round breakdown, they highlight a growing trend of treating major crypto assets as part of corporate balance sheet strategy.

Overall, the Web3 fundraising landscape in July 2025 clearly demonstrated a shift toward a growth-stage dominance and deeper institutionalization.

Investors are no longer blindly chasing early-stage narratives; instead, they are heavily backing projects with proven market validation, regulatory clarity, and sustainable business models—particularly those in the mid-to-late stages such as Series A and B.

At the same time, traditional financial instruments like PIPE (Private Investment in Public Equity) and Post-IPO funding are rapidly integrating into the Web3 ecosystem. The trend of allocating raised funds toward major crypto assets (e.g., BTC, ETH, SOL) as treasury reserves further reflects the diversification and growing sophistication of project financial strategies and structures.

According to data published by Cryptorank on August 5, 2025, Colosseum led the month with 9 investments, highlighting its high-frequency deployment and wide early-stage coverage. Coinbase Ventures (7 deals) and Animoca Brands (5 deals) followed, continuing their roles as strategic investors with a strong focus on infrastructure and content ecosystem expansion.

In terms of lead investor activity, institutions such as Amber Group, Susquehanna International Group (SIG), CoinFund, and Faction took part in multiple lead roles—showcasing their influence in valuation, deal structuring, and ecosystem integration.Notably, SIG and Amber Group, both with traditional finance backgrounds, are increasingly acting as key accelerators in the Web3 space.

Overall, top-tier investors remain active, while emerging and traditional capital are rapidly converging. The intersection of TradFi institutions and crypto-native funds in early-stage investment is driving the Web3 ecosystem toward more mature and sophisticated capital operations.

Highlighted Project of the Month

Delabs Games

Overview: Delabs Games is a Web3 game development studio founded in 2021 by James Joonmo Kwon, former executive at Nexon. Since its inception, the team has developed multiple blockchain-based games, including Rumble Racing Star, Space Frontier, and Metabolts, aiming to deliver fun and playable Web3 gaming experiences built from the ground up.【3】

On July 21, Delabs Games announced the completion of a $5.2 million Series A round led by Hashed, bringing its total funding to $17.2 million.【4】

Investors/Angel: Hashed, TON Ventures, Kilo Fund, IVC, Taisu Ventures, Arche Fund (Coin98), Yield Guild Games (YGG), Everyrealm, Jets Capital, among others.

Highlights:

- Delabs is dedicated to breaking the centralized limitations of traditional games by leveraging blockchain technology to grant players ownership of in-game assets. Through its generative AI platform Verse8, it lowers development barriers, enabling users and creators to build multiplayer game scenes via natural language prompts—driving community-led content co-creation and circular in-game economies.

- Its first game, Boxing Star X, has validated the viability of a “light-social + Web3” game model, generating over $300,000 in monthly revenue and an ARPPU exceeding $200. The game is nearing 2 million global users and recently ranked 7th on DappRadar’s global game chart, surpassing well-known titles like Axie Infinity. The next title, Ragnarok: The Lost Memories, has already surpassed 100,000 pre-registrations despite not yet being released.

- The team combines top-tier Web2 and Web3 experience: Founder James Joonmo Kwon is the former CEO of Nexon, known for hits like MapleStory and Dungeon & Fighter; co-CEO JC Kim is a co-founder of Planetarium, with deep expertise in blockchain gaming. Their investor network includes NFT thought leader Dingaling, digital asset fund Grail, accelerator Liquid X, and YGG co-founders—offering strong ecosystem resources.

Gaia Labs

Overview: Gaia is a decentralized AI network aiming to redefine how intelligence is built, distributed, and owned. Its peer-to-peer infrastructure enables anyone to run AI models and agents across a global network of independent nodes—ensuring transparency, privacy, and resilience. Gaia Labs is the core team behind the early development of the Gaia network. 【5】

On July 23, Gaia Labs announced it had raised $20 million across Seed and Series A rounds, led by ByteTrade, SIG Capital (Susquehanna), Mirana, and Mantle Eco Fund. 【6】

Investors ByteTrade, SIG Capital (Susquehanna), Mirana, Mantle Eco Fund, EVM Capital, Taisu Ventures, NGC Ventures, Selini Capital, Presto, Stake Capital, FactBlock, G20, Amber, Cogitent Ventures, Paper Ventures, Republic Crypto, Outlier Ventures, MoonPay, BitGo, SpiderCrypto, Consensys Mesh, and more.

Highlights:

- Gaia is building a leading global decentralized AI inference network based on a distributed node architecture. Currently, Gaia operates over 700,000 active nodes that have completed more than 17 trillion inference tasks across thousands of blockchain ecosystems. The network is supported by over 1 million unique wallets, showcasing massive adoption and decentralization.

- The node system is a key technical highlight. Each node can host AI models and independently run inference tasks, with operators able to use local devices, GPU servers, or personal computers. Gaia Labs has integrated major open-source large language models (LLMs), including Meta’s LLaMA, Google’s Gemma/CodeGemma, Microsoft’s Phi series, and Alibaba’s Qwen—providing a diverse, high-performance AI model foundation.

- A flagship application is the Gaia AI Phone—an AI-native smartphone based on Galaxy S25 Edge hardware. Unlike other AI phones, all AI agents and models run locally on-device, without relying on cloud computation or uploading user data, fundamentally safeguarding data ownership and privacy.

- To ensure secure and trustworthy AI computations, Gaia introduces “verifiable inference” mechanisms, including node staking. Gaia Labs is also building a robust developer toolchain, offering open agent frameworks and SDKs to make developing AI apps on Gaia as accessible as building websites on WordPress.

Syntetika

Overview:Syntetika is a decentralized platform for issuing and trading tokenized assets. It supports a range of financial products, including yield-generating crypto products, tokenized equity of private (non-listed) companies, and representations of real-world assets (RWA).【7】

On July 17, Hilbert Group announced that Syntetika had closed a $2.5 million seed round for its tokenization and decentralized exchange platform.【8】

Investors: Russell Thompson (CIO at Hilbert Group), John Lilic (Advisor at Hilbert, Head of Nordark), Alex Berto (Co-founder of Aave and Allez Labs), and others.

Highlights:

- Syntetika focuses on compliant tokenized asset issuance and trading, integrating blockchain infrastructure with regulatory frameworks. The platform incorporates Galactica’s zero-knowledge KYC (zkKYC) system to ensure enterprise-level auditability while preserving user privacy—creating a decentralized and compliant digital asset ecosystem. Its mission is to streamline the issuance, trading, and management of on-chain assets while enhancing the efficiency and security of traditional asset tokenization.

- By combining DeFi liquidity with structured product design, Syntetika offers a tokenization platform tailored for institutions. Its first product tokenizes Hilbert Group’s Bitcoin yield strategy, allowing users to earn additional yield while holding BTC. Leveraging Hilbert’s quantitative finance expertise, the platform aims to provide structured, yield-bearing products for both institutional and retail users.

- Syntetika has formed a strategic advisory board that includes Max Rabinovitch (CSO at Chiliz), Vladimir Maslyakov (CTO at Blum), Chirdeep Chhabra (former Head of Tokenization at Citi), and John Lilic (Advisor at Polygon), offering strategic direction and deep industry resources to support platform development.

Blockskye

Overview: Blockskye is a blockchain-based corporate travel and payment platform designed to simplify booking, expense tracking, and reconciliation processes. Through integration with KAYAK for Business and PwC systems, it eliminates intermediaries and makes direct payments to vendors via its Blockskye Pay system.【9】

On July 17, Blockskye announced a $15.8 million Series C funding round led by Blockchange. The funds will be used to expand into Europe, Latin America, and Asia, and to develop real-time stablecoin-based payment products.【10】

Investors/Angel Backers: Blockchange, United Airlines Ventures, Lightspeed Faction, KSV Global, Lasagna, Litquidity Ventures, Longbrook Ventures, TFJ Capital, and others.

Highlights:

- Blockskye leverages blockchain to streamline corporate travel, enabling flight bookings, expense management, and payment processing without relying on traditional intermediaries like travel agencies or credit card networks. Current clients include PwC, TripAdvisor, and Diageo. With the new funding, the company aims to expand its footprint among Fortune 500 companies and accelerate international growth.

- Its real-time ownership tracking feature improves resource allocation, helping agencies cut spending by 84% and recover millions of unused tickets. The company claims to reduce overall travel costs for enterprises by approximately 14.5%.

- Blockskye is launching a new generation of payment products that implement stablecoin-based per-transaction settlement. Unlike batch-based corporate payment systems, Blockskye enables real-time, transaction-level settlements for transparent, controlled, and delay-free cash flow—bringing a structural shift to enterprise payments. Rather than “blockchain-izing” legacy systems like credit cards or invoices, Blockskye aims to rebuild the corporate travel and payments infrastructure from the ground up with data synchronization and smart contracts at its core.

Limitless

Overview: Limitless is a decentralized prediction market platform where users can wager on real-world events, operating similarly to binary options. It generates daily markets based on public price data, resembling zero-day-to-expiry (0DTE) options and offering high-frequency, short-term trading opportunities.【12】

On July 1, Limitless announced a $4 million strategic round, bringing its total funding to $7 million.【12】

Investors: Coinbase Ventures, 1confirmation, Maelstrom, Collider, Node Capital, Paper Ventures, Public Works, Punk DAO, WAGMI Ventures, and others.

Highlights:

- Limitless combines an order book trading system with innovative liquidity mechanisms to deliver a flexible, high-efficiency trading experience. Each market features dual order books (Yes/No) with support for both market and limit orders. Share merging and splitting mechanisms enhance capital efficiency, and a daily USDC rewards program incentivizes LPs to provide liquidity near the mid-price, tightening spreads. Market outcomes are verified by the Pyth Network oracle. The platform also provides APIs and smart contract interfaces for developer integration.

- Limitless has become the largest prediction market on the Base network, with over $250 million in total contract volume. Users can predict short-term price movements (minutes, hours, or one day) of specific assets, offering a simple, retail-friendly, high-frequency trading method that significantly lowers entry barriers.

- A points-based user incentive program has been launched to prepare for its Token Generation Event (TGE). Users earn points through trading, providing liquidity, and referrals, with potential eligibility for a future token airdrop. As one of the first prediction markets to reward early users with tokens, Limitless is quickly building a dedicated core user base.

Conclusion

In July 2025, the Web3 industry saw a total of $3.68 billion in funding across 132 deals, signaling continued investor enthusiasm. The month was marked by growing institutionalization and capital concentration, with Post-IPO and PIPE funding rounds becoming mainstream pathways—evidence of deeper integration between Web3 and traditional capital markets. Notably, a growing number of projects are allocating fundraising proceeds to build reserves in mainstream crypto assets.

Funding was concentrated in CeFi ($1.62B) and blockchain services ($1.4B), reflecting a structural trend toward infrastructure-first and service-driven models. In contrast, application-layer fundraising remained relatively subdued. Capital shifted toward mid-stage growth projects, with 47.5% of deals falling in the $3M–$20M range, and Series A rounds proving the most active. This indicates a pivot from narrative-driven investments to growth-validated ones, with a sharper, more strategic investment focus.

The month’s standout funding projects further validated the Web3 market’s evolution toward maturity and diversification:

- Delabs Games showcased innovations in Web3 gaming and monetization, emphasizing player ownership and AI-powered game creation.

- Gaia Labs exemplified the rise of decentralized AI infrastructure, with applications like the Gaia AI Phone bridging Web3 and real-world utility.

- Syntetika and Blockskye highlighted the potential of tokenized real-world assets (RWA) and blockchain-based enterprise applications—especially in compliance and real-time settlement.

- Limitless, as a prediction market, underscored ongoing innovation in on-chain financial tools and user incentives.

Overall, the Web3 fundraising landscape is entering a more commercially viable and top-heavy cycle, led by maturing teams and validated business models.

Reference:

- Cryptorank , https://cryptorank.io/funding-analytics

- Cryptorank, https://cryptorank.io/funding-rounds

- Delabs Games, https://delabs.gg/

- GamesBeat, https://gamesbeat.com/with-5-2m-series-a-delabs-games-levels-up-web3-ambitions/

- Gaia, https://www.gaianet.ai/

- Gaia, https://www.gaianet.ai/blog/gaia-labs-raises-20m-series-a/

- Syntetika, https://syntetika.io/

- Hilbert Group, https://hilbert.group/en/hilbert-group-closes-heavily-oversubscribed-seed-round-for-syntetika-tokenisation-and-decentralised-trading-platform/

- Blockskye, https://www.blockskye.com/

- The Block, https://www.theblock.co/post/363173/blockskye-funding-blockchain-corporate-travel

- Limitless, https://limitless.exchange/simple/markets/59

- Cointelegraph, https://cointelegraph.com/press-releases/limitless-raise-4m-strategic-funding-launch-points-ahead-of-tge

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Detailed Analysis of the FIT21 "Financial Innovation and Technology for the 21st Century Act"

Gate Research-A Study on the Correlation Between Memecoin and Bitcoin Prices

Gate Research: Web3 Industry Funding Report - November 2024