Glassnode

No content yet

glassnode

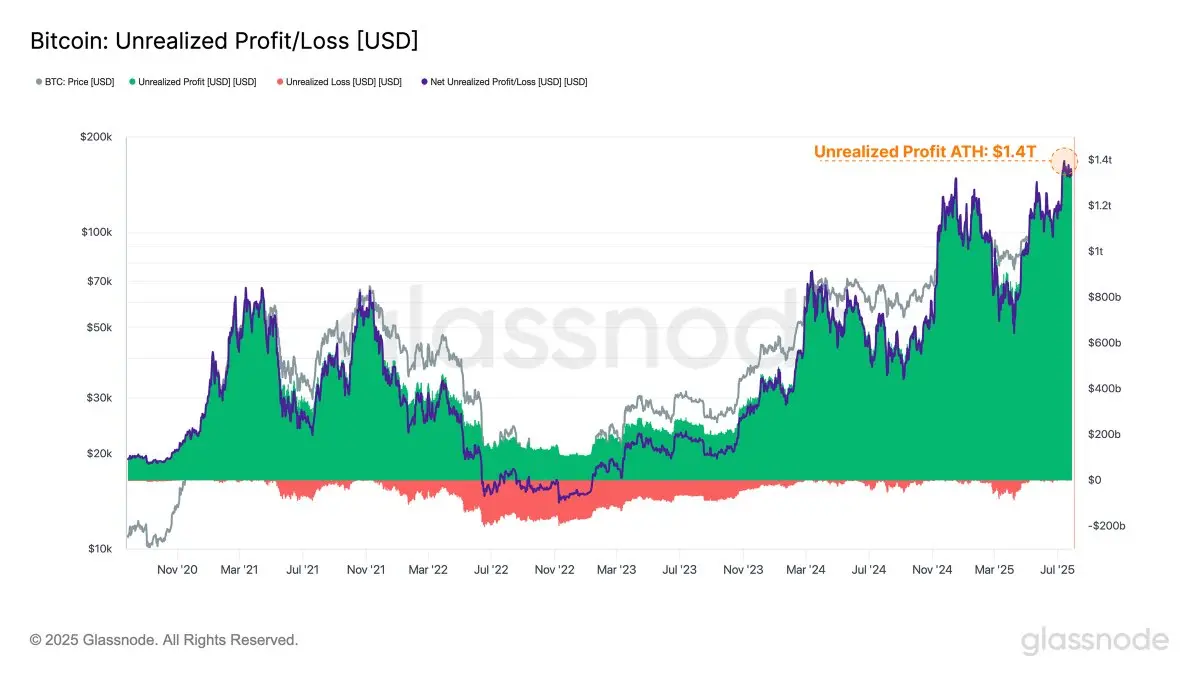

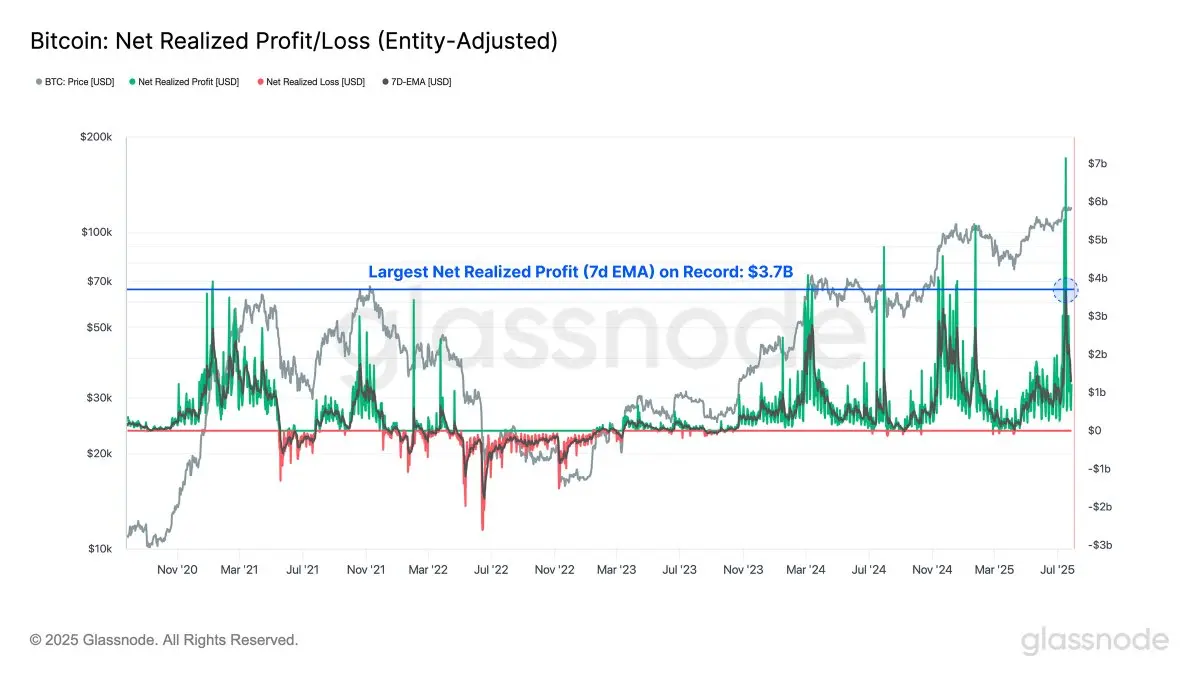

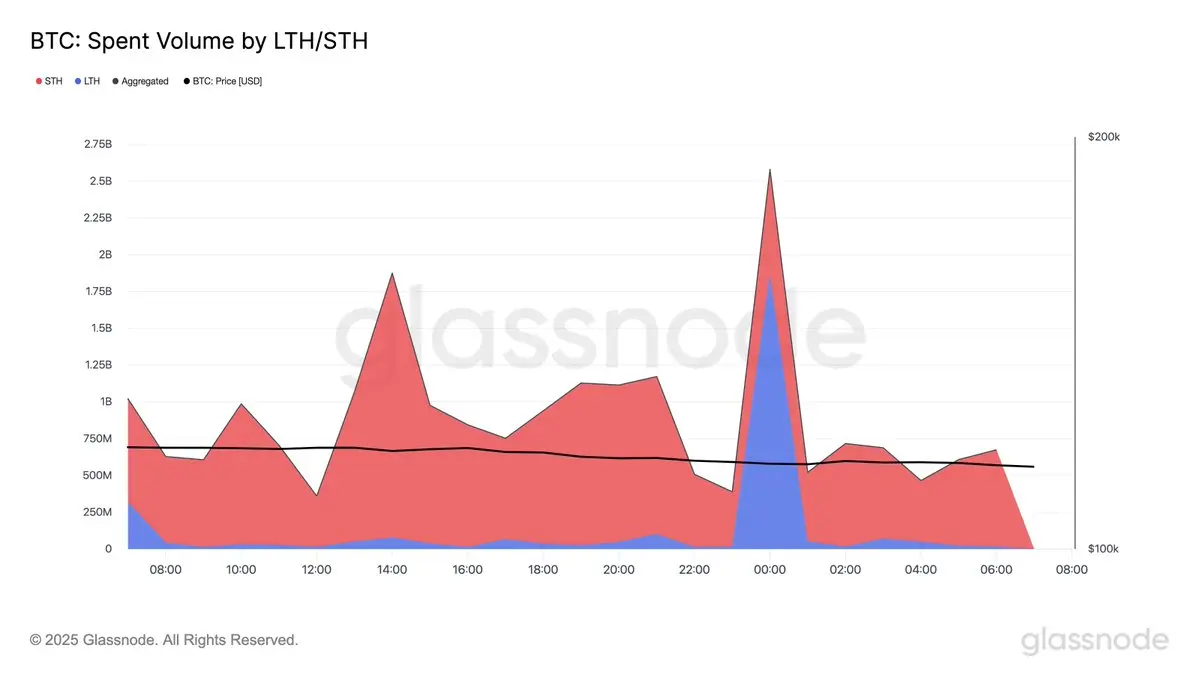

Over the past 24 hours, the vast majority of $BTC spent volume came from Short-Term Holders (STH):

🔸STH: $18.24B (85.5%)

🔸LTH: $3.10B (14.5%)

🔸Total spent: $21.34B

This suggests the sell-off is primarily driven by recent buyers rather than long-term investors.

🔸STH: $18.24B (85.5%)

🔸LTH: $3.10B (14.5%)

🔸Total spent: $21.34B

This suggests the sell-off is primarily driven by recent buyers rather than long-term investors.

BTC-1.51%

- Reward

- like

- Comment

- Share

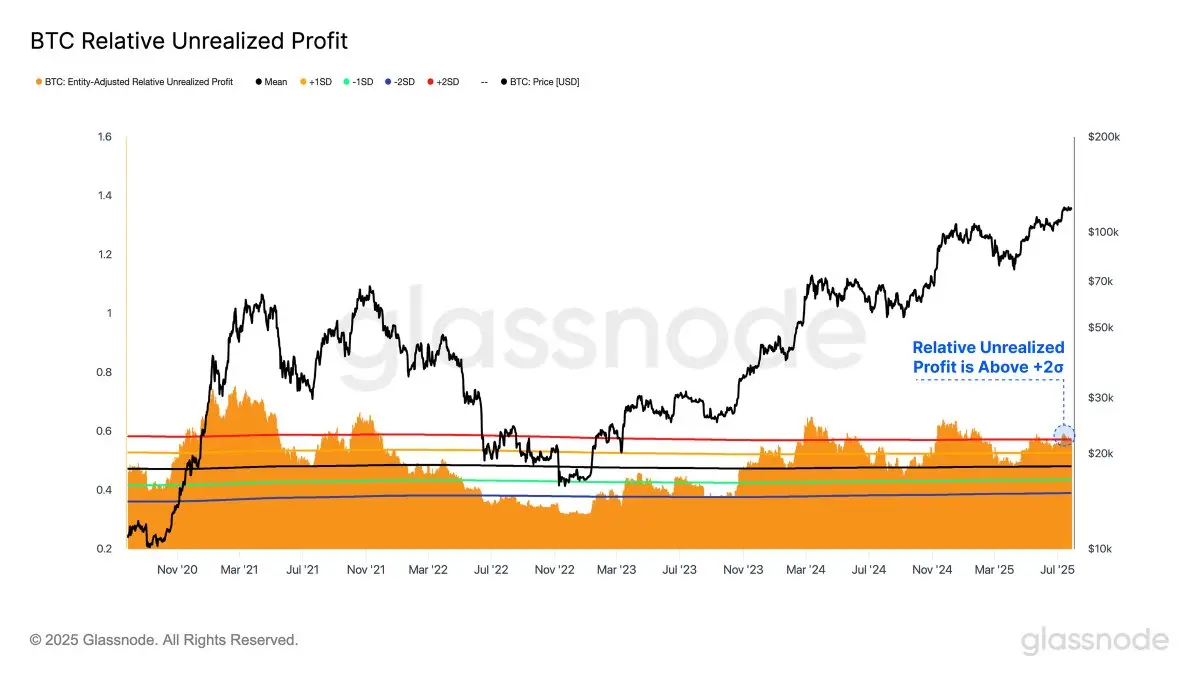

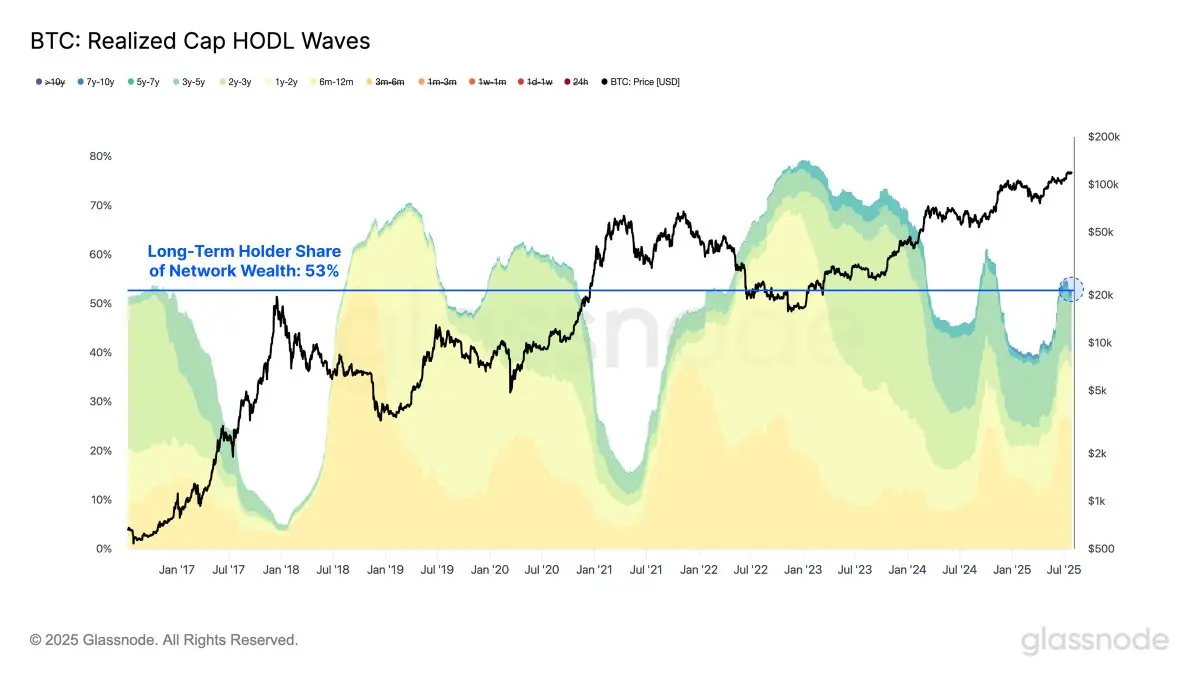

The LTH/STH Supply Ratio - comparing $BTC supply held by long-term investors to new entrants - dropped -11% over 30 days, reflecting continued rotation into distribution. This pattern has preceded prior ATHs and highlights a structurally consistent shift in investor positioning.

BTC-1.51%

- Reward

- like

- Comment

- Share

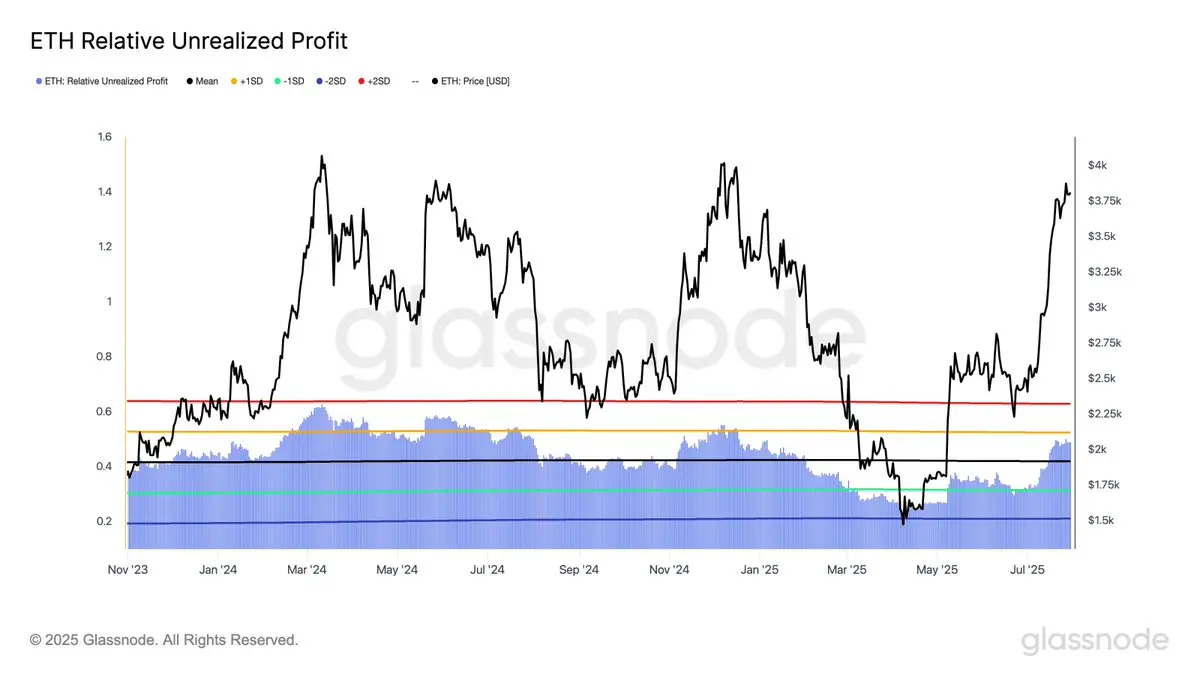

#ETH# ’s +1σ Active Realized Price band - currently at $4.5K - marks a key upside threshold for the current rally. This level acted as resistance in March 2024 and during the 2020–21 cycle. Breakouts above it often signal market euphoria and rising risk of structural instability.

- Reward

- like

- Comment

- Share

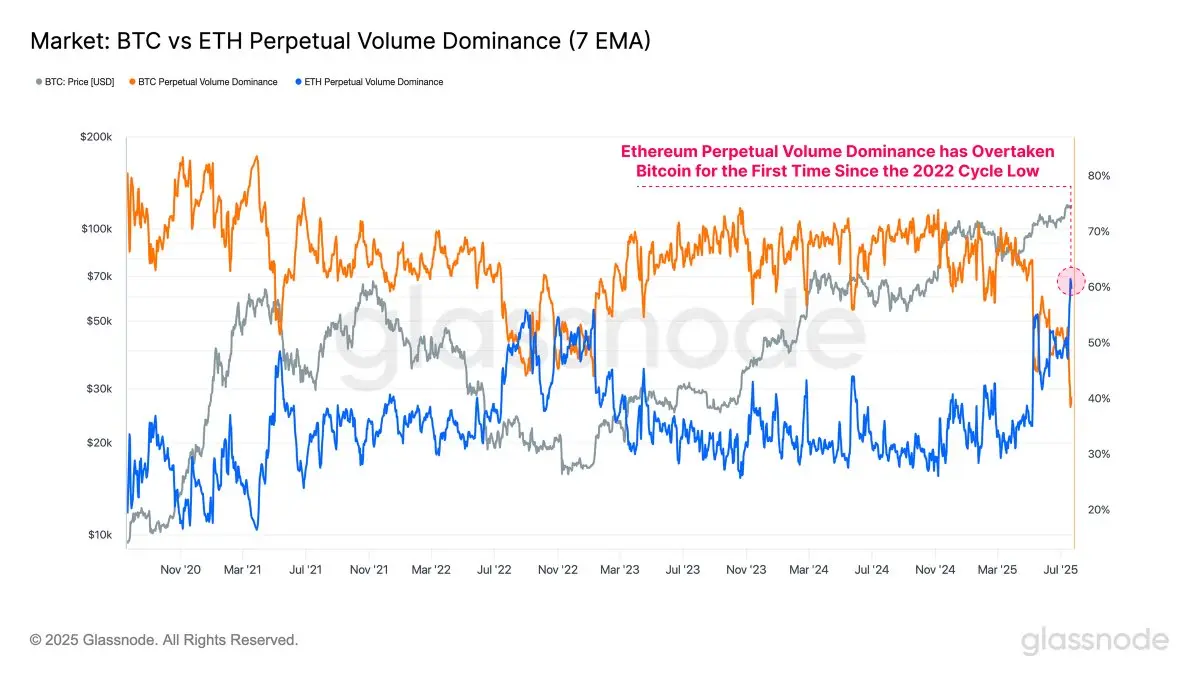

#Ethereum# perp volume dominance has recently overtaken #Bitcoin# for the first time since the 2022 cycle low - marking the largest volume skew in $ETH favor on record. This shift confirms a meaningful rotation of speculative interest toward the #altcoin# sector.

- Reward

- like

- Comment

- Share

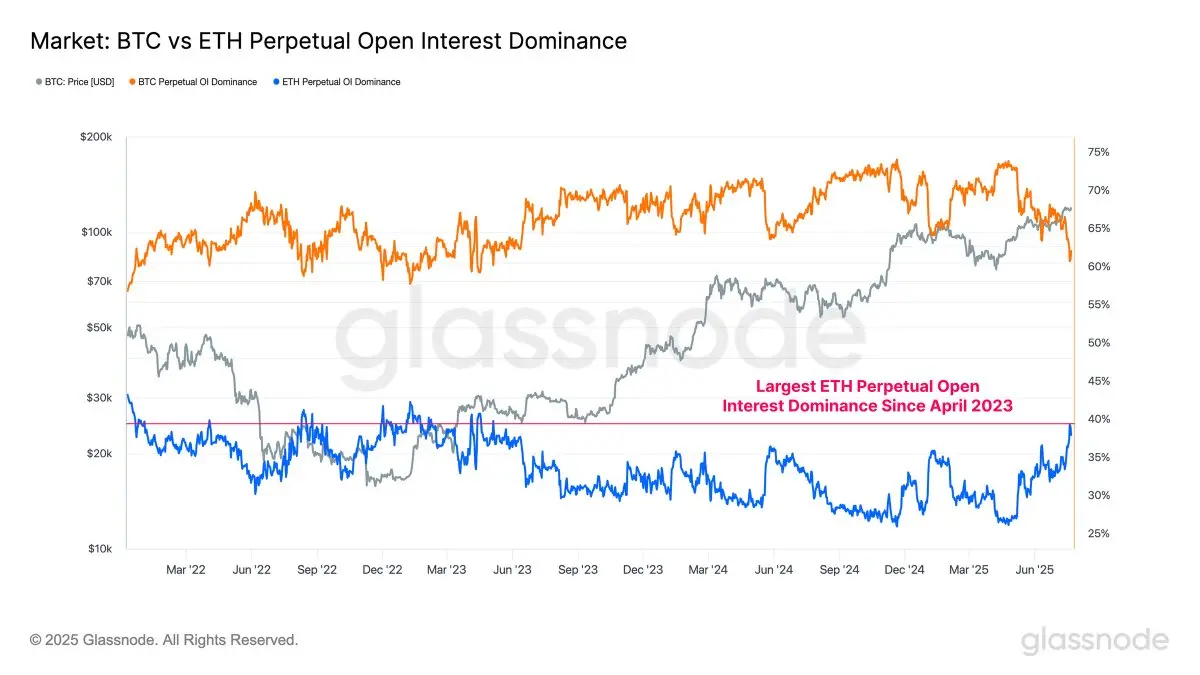

#Ethereum# open interest dominance has climbed to nearly 40%, its highest level since April 2023. Only 5% of days have seen a higher reading. This marks a clear shift in speculative focus, with capital rotating from $BTC to $ETH at the margin.

- Reward

- like

- Comment

- Share

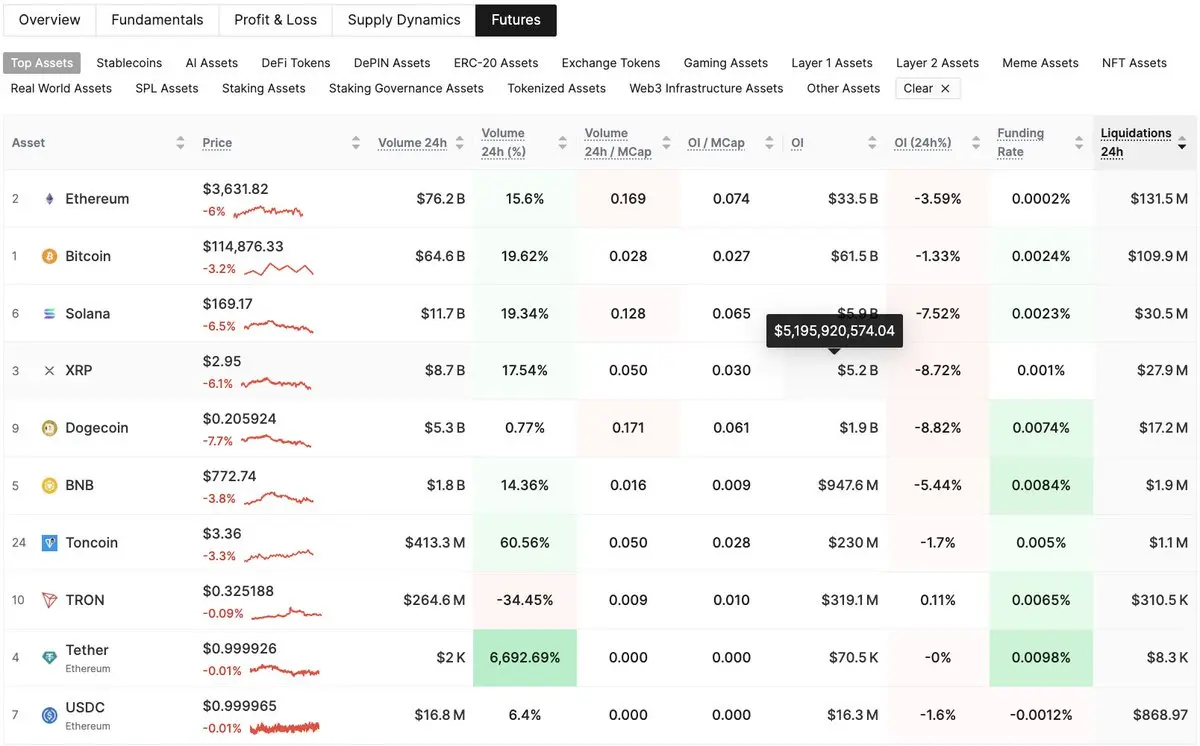

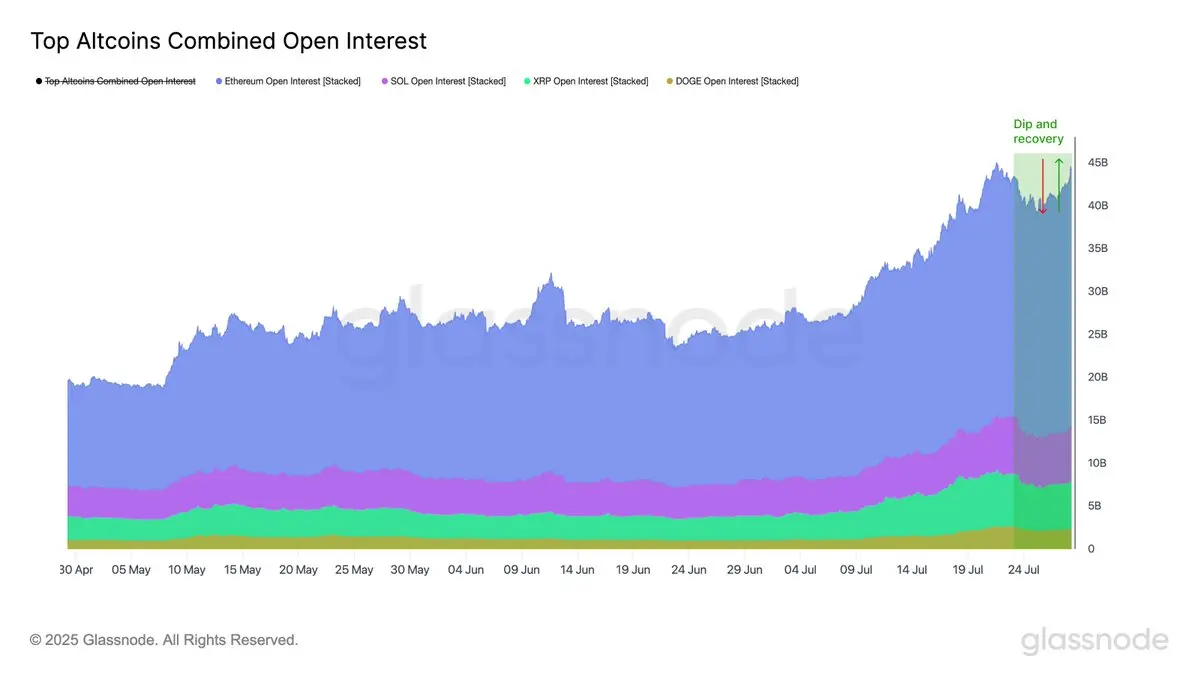

After dipping slightly before the weekend, Futures OI across major #altcoins# is recovering. The combined OI of $ETH, $SOL and $XRP has rebounded sharply to $44.2B - just shy of last week’s high ($45B). $ETH OI saw the biggest swing while $SOL and $XRP were more stable.

- Reward

- 1

- Comment

- Share

- Reward

- like

- Comment

- Share

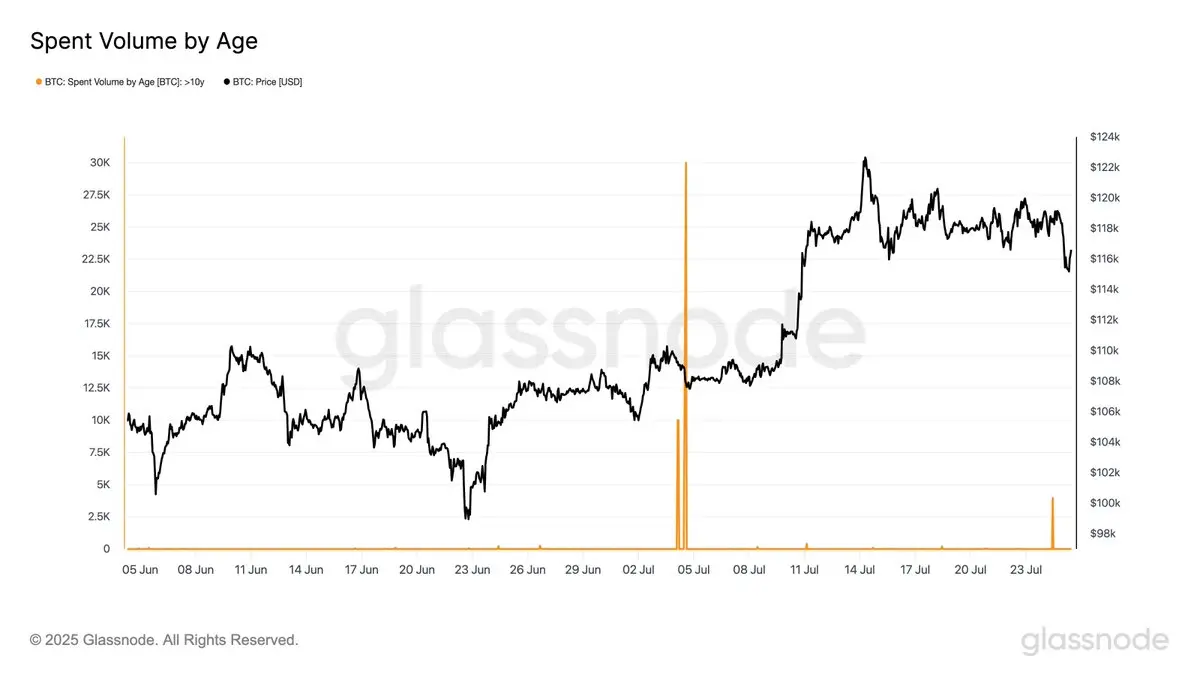

Yesterday saw another wave of ancient coins move on-chain, with 3.9k BTC aged over 10 years becoming active. This follows the 80k BTC that moved on July 4, 2025. Such activity from long-dormant supply often reflects internal reallocation, custodial shifts, or in some cases sell-side pressure.

- Reward

- like

- Comment

- Share